Key Takeaways

- Bitcoin’s price struggles as the crypto asset saw a market dump towards a weekly low, raising concerns of a bear market.

- Price retested a key region of $103,000 as bulls stepped in to help price rebound towards a region of $115,000.

- BTC price must trade above the key resistance of $124,000 for a potential rally to new all-time highs despite M2 sentiment.

The crypto market on October 11th saw one of the largest market crashes in history since COVID-19, wiping out over $15 billion in 24 hours and $7 billion in less than 60 minutes, as US President Donald Trump announced a 100% tariff slam on China, leading to a market crash as Bitcoin (BTC) fell to a low of $103k.

The crypto market was not the only market affected, as the US stock market also saw over $1.6 trillion wiped out, leaving many traders and investors blaming Trump and his influence on the market.

In the last few days, Bitcoin and altcoins have struggled to show strong bullish price action. Traders, investors, and crypto experts have accused centralised exchanges like Binance of manipulating the market, resulting in significant uncertainties about the market’s potential to rally to new highs.

Amid recent uncertainties about whether the bull market will continue or if it is currently at its peak, crypto experts have insisted that the market hasn’t topped out. They suggest the market is in its early phase and has significant potential to rally higher in the coming weeks.

M2 Indicators Suggest Bitcoin (BTC) to New Highs

According to a recent analysis by MaxCrypto, the recent crypto market dump is expected to be temporary, as the market is still on track to a historical high of $200k based on his M2 BTC indicator. The price of BTC has, on several occasions, followed the M2 indicator to new highs.

The crypto expert further shared a previous chart showing how Bitcoin has followed its price. This gained significant attention on X (formerly Twitter), as traders and analysts believe that panic will be replaced by euphoria when the price follows the indicator.

While the current price action for BTC to $200k remains in doubt, Michael Saylor has hinted at more purchases for Bitcoin, as the company has a long-term belief and speculation that the BTC price will trade towards a region of $1 million.

Despite such an ambitious take on BTC’s potential, what is the short-term price potential following the recent market crash?

BTC Price Analysis

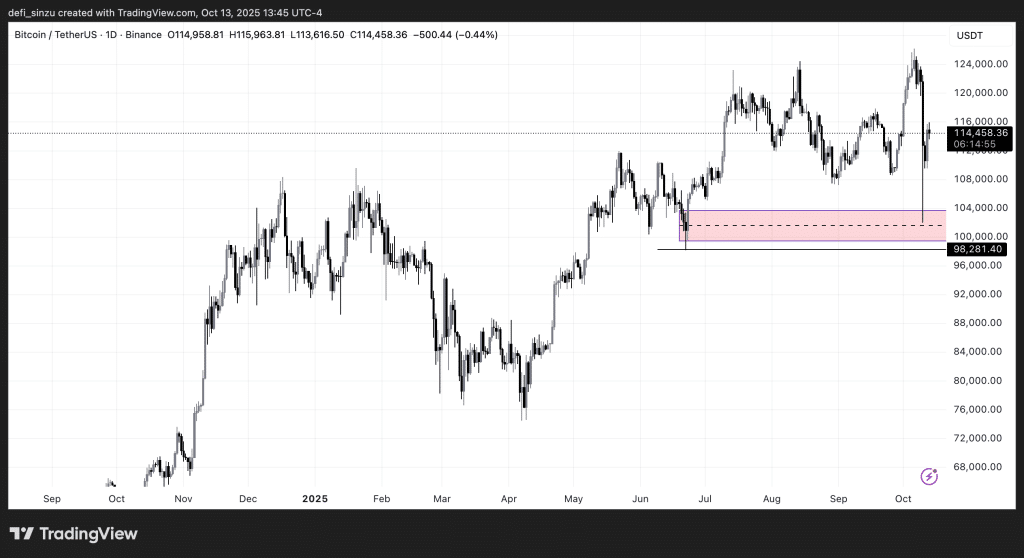

Source – Bitcoin Daily Price Analysis from TradingView

Bitcoin saw a market crash from a region of $126,500 to a low of $103,000, wiping out billions of dollars from the market. What seemed like a minor retracement in the price of the most traded cryptocurrency showed strong bullish price action in early October, with hype suggesting a range of $130k to $150k was ideal.

The price of the crypto asset currently faces significant resistance around $124,000; a breakout above this zone could lead to a rally towards $130,000 for BTC. However, traders and investors need to be wary of rejection, which could see the price retest lower price zones.

FAQs

Why is the Bitcoin price falling today?

The price of BTC crashed from a high of $124k after a price rejection in this area, trading below $103k following the news of a 100% tariff on China.

What is M2 Bitcoin?

The M2 BTC indicator displays the money supply in the market, and crypto traders and experts have utilized it to gauge the level of liquidity.

What is global M2 now?

Bitcoin’s global M2 currently trades around $ 92 billion, as the price of the crypto asset has shown a better correlation over the years.

Related Read