Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Raydium (RAY) Market Update

Raydium (RAY) seems to be moving downwards, but technical indicators and chart patterns tell us a different story.

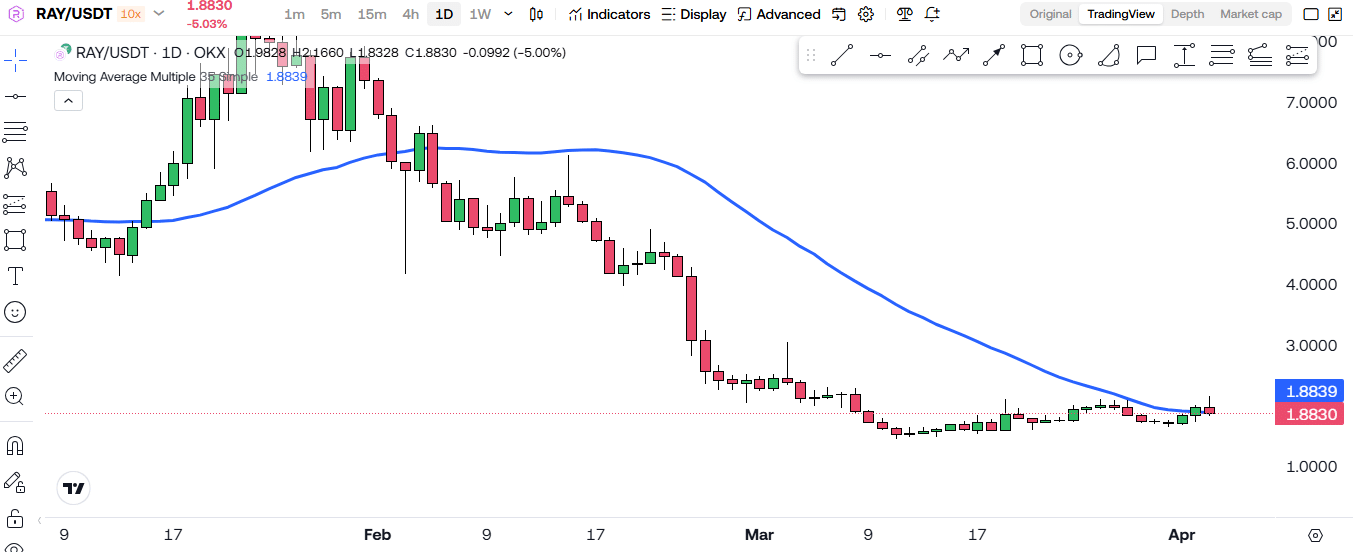

If we take a closer look at its moving averages, we can see that Raydium has managed to break above the 100-day moving average (100MA). This is a significant development, as maintaining a price above the 100MA suggests that the asset has the potential to move even higher. A sustained breakout above this level could indicate a bullish trend, attracting more traders and investors to the market. The 100MA often acts as a strong support level, and staying above it could fuel further upward movement. If buyers continue to hold the price above this level, we may see a more prolonged rally in the coming weeks.

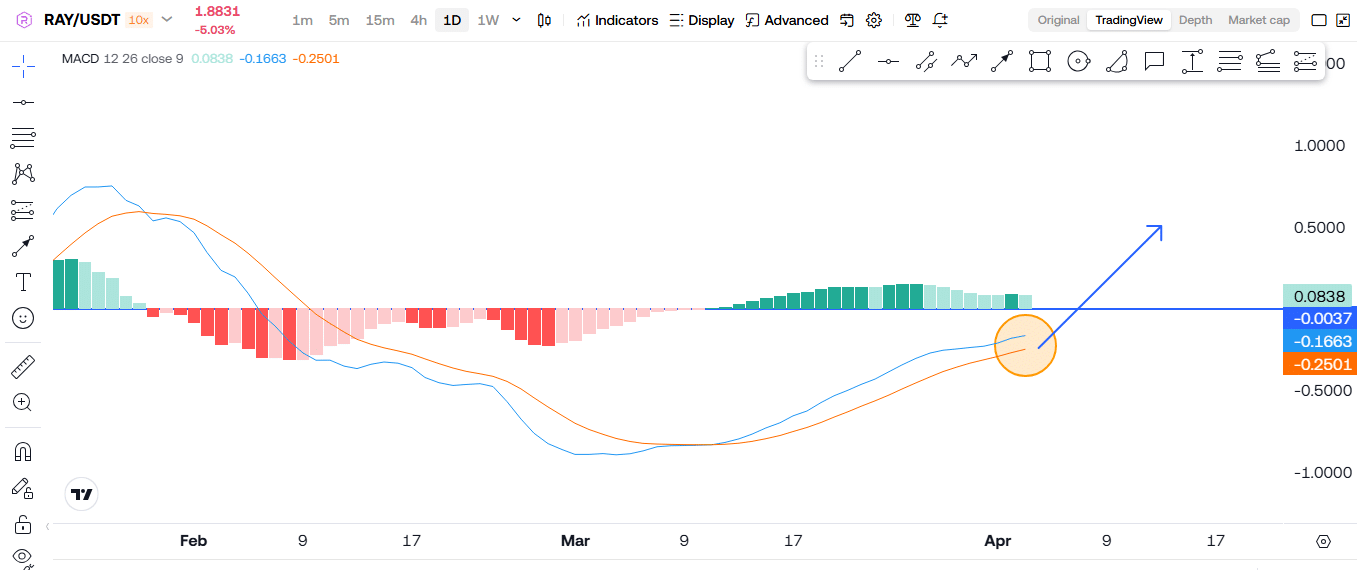

Another indicator that hints at a potential upward move is the MACD (Moving Average Convergence Divergence). The MACD is gradually moving upwards, which suggests growing positive momentum. If it continues in this direction and manages to push above the green bars, there is a strong possibility of a price surge in the near future. Traders typically look at this as a confirmation of bullish momentum, signaling that more buying pressure could be on the way. A crossover between the MACD line and the signal line could provide an even stronger confirmation of an uptrend.

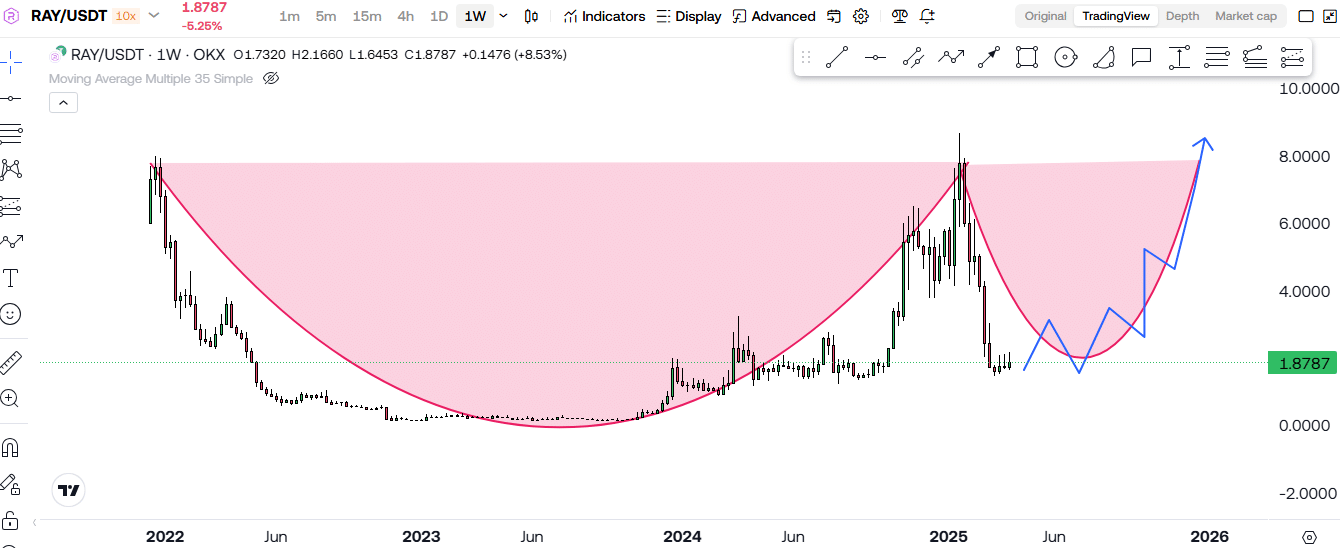

Apart from these indicators, there is also a notable pattern forming on the charts: the cup and handle pattern. If we zoom out and examine the weekly timeframe, we can observe that Raydium has already formed the cup portion of this pattern. What’s missing is the handle, which typically follows before a strong breakout to the upside. The cup and handle is a well-known bullish continuation pattern, often leading to significant price increases once the breakout occurs.

For this pattern to complete, Raydium must continue to trade above the 100MA while maintaining positive momentum in the MACD. If these conditions align, we could soon see the handle formation, which may lead to a significant bullish breakout. Many traders consider the cup and handle pattern as a strong bullish signal, often leading to sharp price increases when confirmed. A confirmed breakout above the handle’s resistance level would serve as a potential entry signal for traders aiming to ride the uptrend.

However, it’s crucial to keep in mind that technical analysis alone does not guarantee price movements. External factors, such as fundamental developments, market sentiment, and global economic conditions, can also play a crucial role in an asset’s price action. Even if the technical setup looks promising, negative news or market-wide downturns could invalidate these patterns and lead to unexpected price movements. Always keep an eye on the overall market trend and news events that might impact Raydium’s price direction.

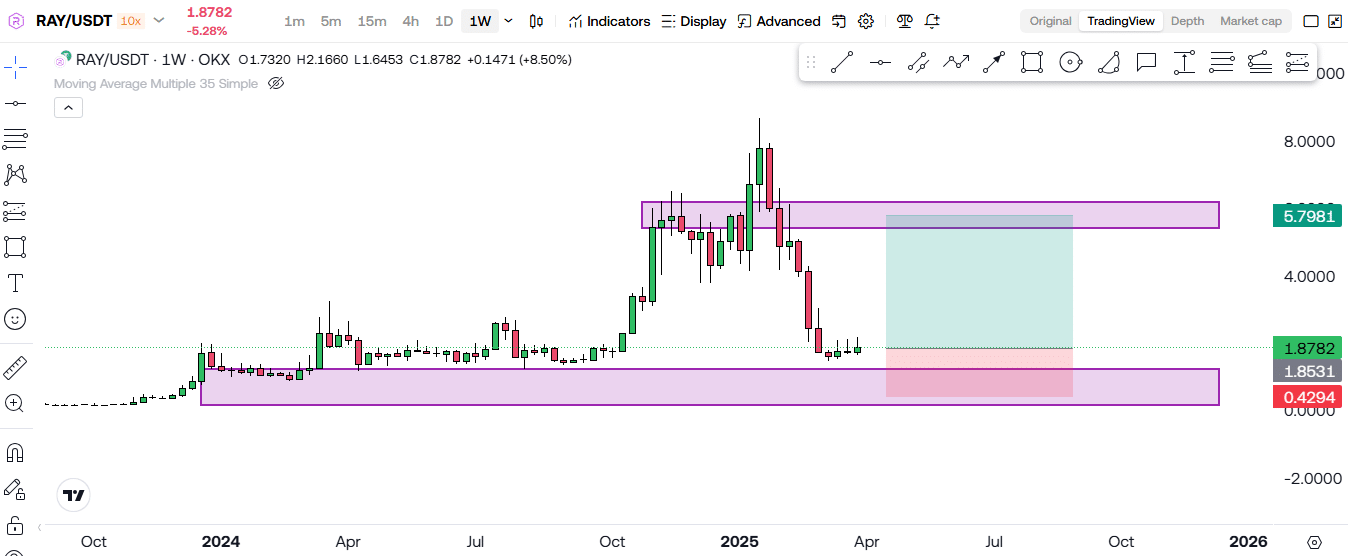

If you are considering trading Raydium, it’s essential to have a well-planned strategy. A prudent approach would be to set a stop-loss level below $1 to minimize potential losses. On the upside, a reasonable take-profit target could be around $5, depending on market conditions. Always remember to trade responsibly, managing your risk effectively and only investing money that you can afford to lose. Additionally, using proper risk-reward ratios and sticking to a disciplined approach will help in maximizing gains while minimizing losses.

Final Thoughts

For more in-depth technical analyses like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!