Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Bitcoin Might Hit $130,000 Soon

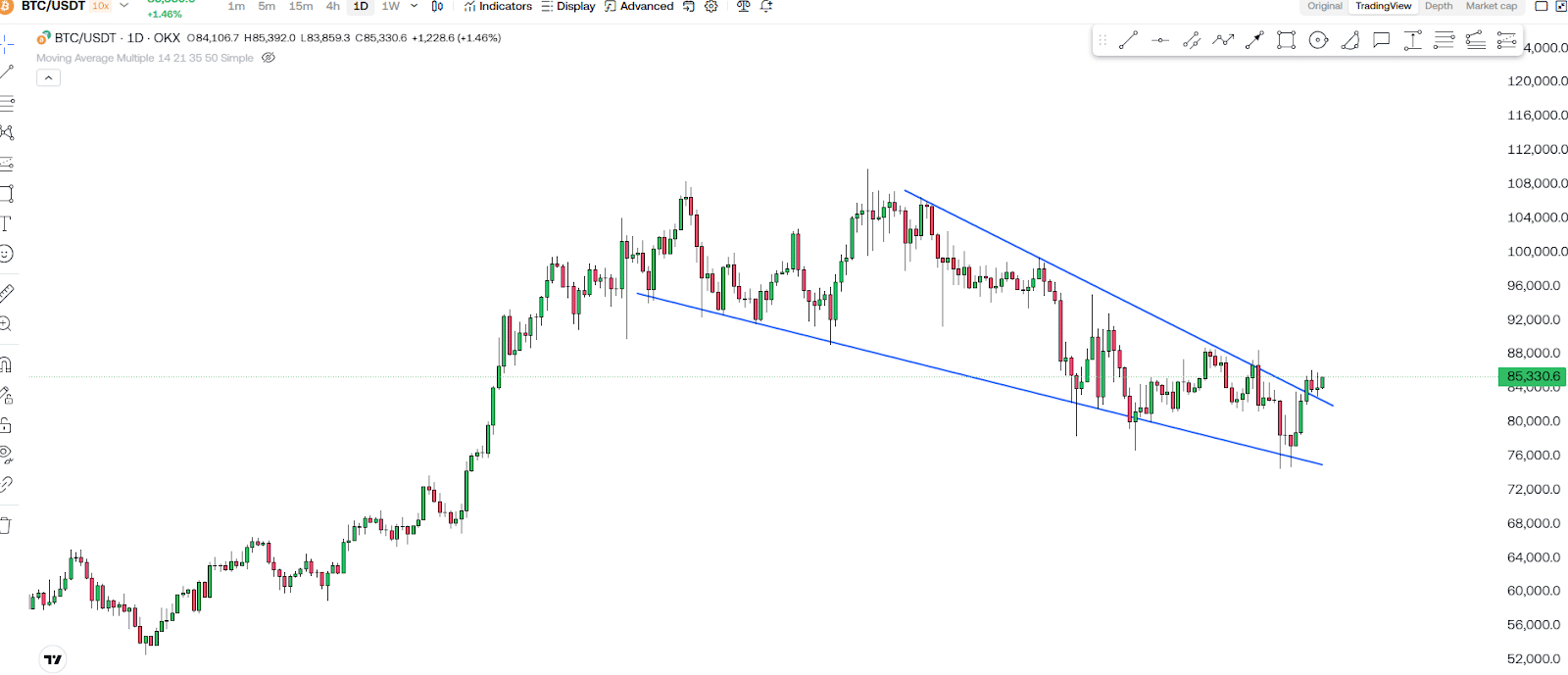

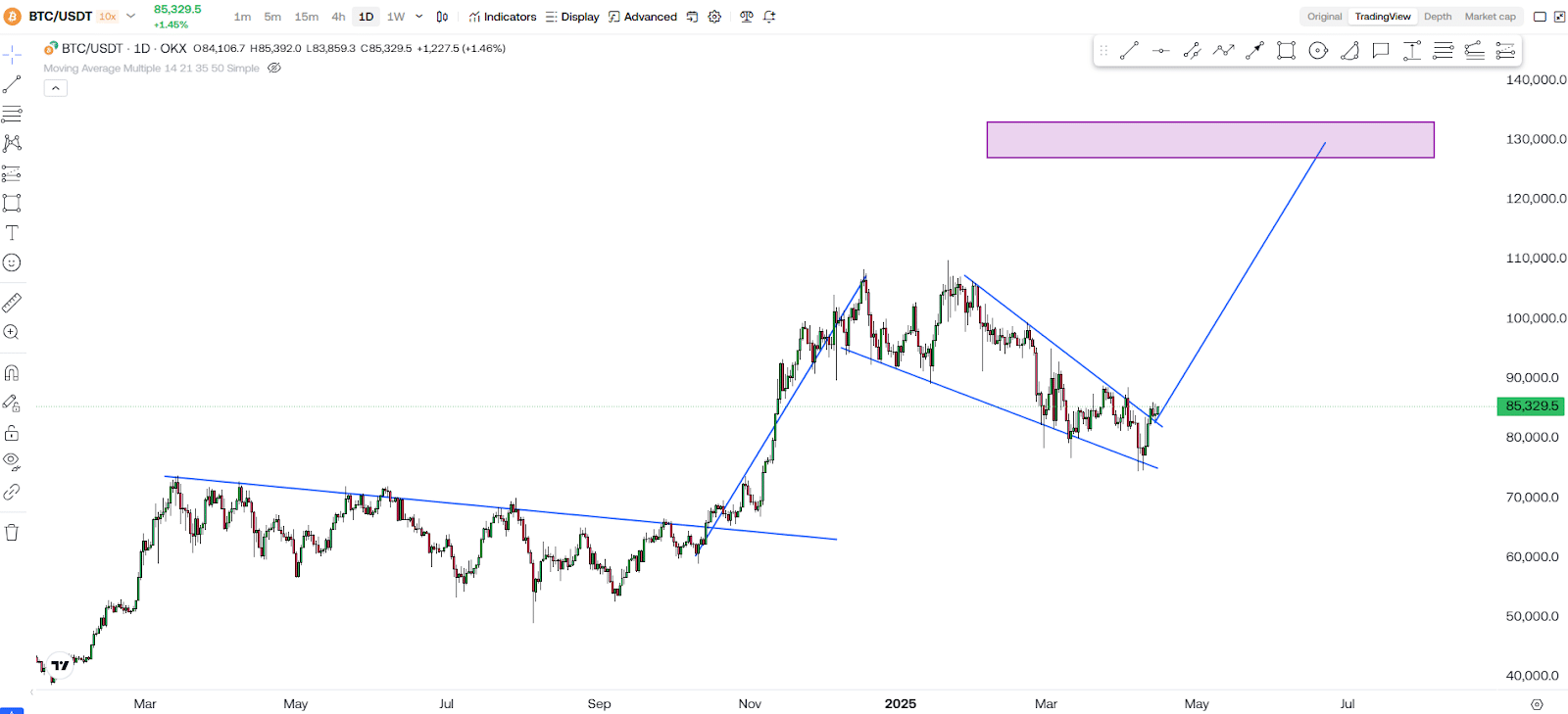

Let’s talk about something exciting that’s starting to show up on the Bitcoin charts. If we plot the current trendlines, we’ll notice a classic falling wedge pattern forming.

Now, if you are into technical analysis, you know that a falling wedge is typically a bullish pattern. It is created when two downward-sloping trendlines converge—this signals that while the price has been dropping, the momentum is slowly fading. And usually, once Bitcoin breaks out of this pattern, a strong upward move follows. It is like a compressed spring—it can only stay down for so long.

What’s even more interesting is if you zoom out a bit and take a look at the bigger picture. You will see that we had a strong breakout in the past, and that previous breakout is now acting as the pole of a flag pattern. The wedge we’re seeing right now is essentially the flag—pointing downwards. This setup is what traders call a “bullish flag,” and it often signals the continuation of the prior trend, which, in this case, is up.

Now, here’s the juicy part. If Bitcoin successfully breaks out above this falling wedge, we can actually use the length of the previous pole to estimate the next potential move. And based on that measurement, Bitcoin could realistically shoot up to around $130,000.

But that is not the only bullish sign we are seeing right now.

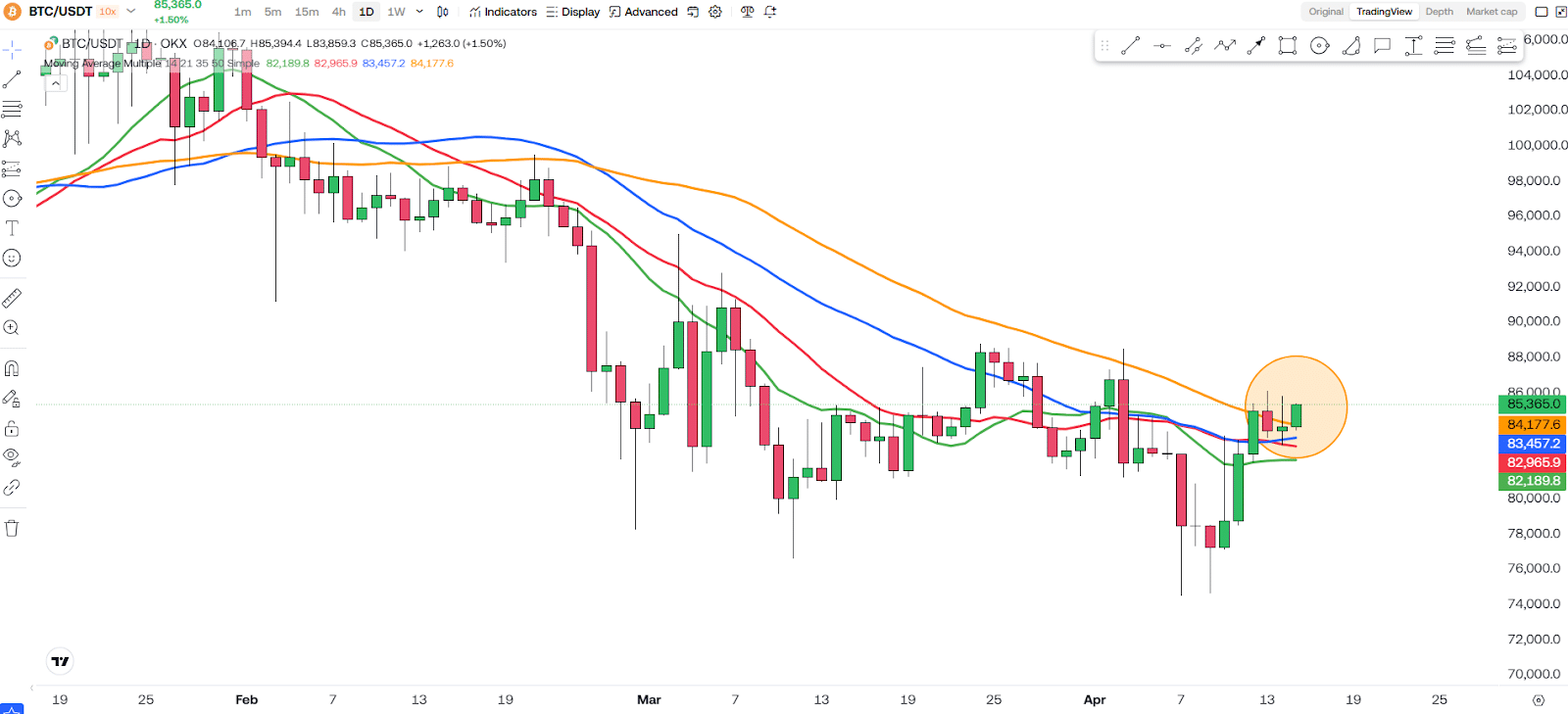

Let’s talk about moving averages for a second—specifically, the 200-day moving average (orange line-200MA). This is a very strong technical level that acts as major resistance in bear markets. But if an asset breaks above it, especially with strong volume, it is often considered a confirmation of a new uptrend.

Right now, Bitcoin is trading above the 200MA, which is huge. This signals that investors are gaining confidence, and more traders could start jumping back in, pushing the price even higher. If Bitcoin can hold above this level and use it as a new support zone, that will add even more fuel to the bullish fire. Resistance turning into support is one of the most reliable signs of strength in a market.

But of course, as with any prediction, there are still risks involved. Global market conditions, regulation news, unexpected sell-offs, and whale activity can all impact Bitcoin’s price direction. So, while all signs point to a potential breakout, it is always wise to stay alert and manage your risks accordingly.

Final Thoughts

In summary, we are seeing a textbook falling wedge forming, a bullish flag setup, a strong breakout pole to guide our next target, and Bitcoin confidently trading above the 200MA. Combine all that, and we might just be on our way to seeing Bitcoin hit that massive $130,000 mark. Let’s keep an eye on this pattern in the coming days because if that breakout happens, it could be one of the biggest moves we have seen in a while.

For more in-depth technical analyses like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!