Key Takeaways

- The cryptocurrency market is facing a dump as Ethereum’s price breaks to a lower price point for the first time in weeks.

- The price could see a strong market dump towards the key support zone of $3,700 in the coming days.

- Experts remain optimistic for price gains ahead of October, sharing key market insights ahead of a potential altcoin season rally.

Ethereum (ETH) traded below $4,000 for the first time in weeks as the price broke below its key support zone of $4,100, raising bearish market concerns for traders and investors, which led to significant market liquidations for ETH long traders.

This significant market crash has been attributed to market uncertainties, microeconomic events, low ETF inflows, and a lack of liquidity in the market, which has hindered its ability to sustain a price increase in the past few days, as the price has struggled to demonstrate bullish price action.

The current low liquidity to sustain ETH’s price to the upside has affected market price action and overall market sentiment, as traders and investors pay close attention to Ethereum’s price following the liquidation of many accounts.

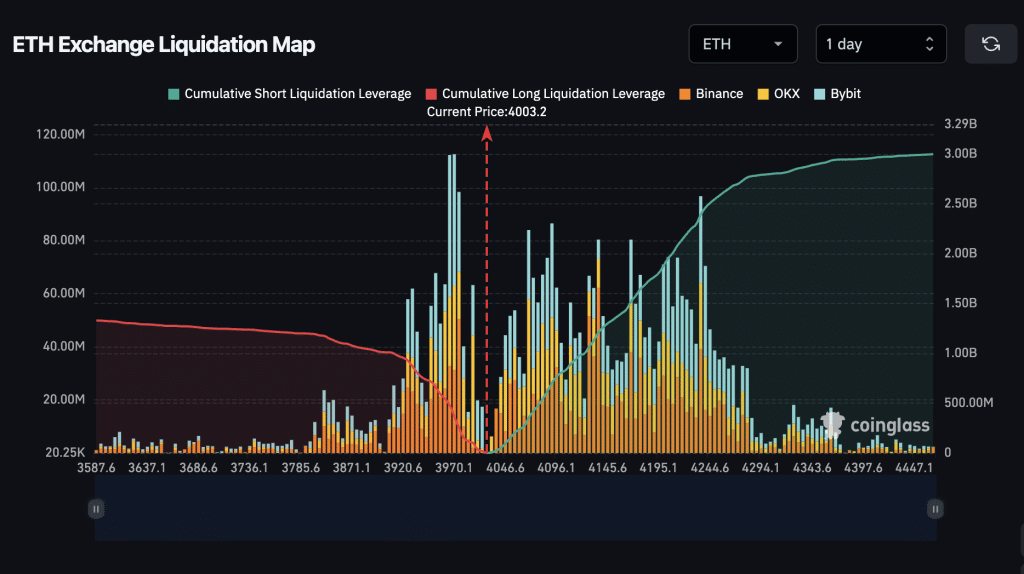

ETH’s On-chain Liquidation Heatmap

Source – ETH’s Liquidation Heatmap from Coinglass

According to on-chain data from Coinglass, over $100 million in long liquidations have been triggered for the Ethereum price in the last few days, indicating that market sentiment surrounding the second-largest cryptocurrency by market capitalization was more focused on upside potential. Still, the price crashing towards $4,000 activated most long orders on exchanges around that zone.

Another trigger for these prolonged liquidations has been the recent low ETF inflow activities, which have affected the over-liquidity buildup to the upside for the crypto asset, as the market was leaning more towards the downside due to low liquidity presence.

Despite such market price action and speculation of further downside potential, traders and investors still maintain an optimistic view regarding the potential of the crypto asset, suggesting that the price could retest a key low of $3,850 before a bullish continuation to the upside of $5,000 and likely $10,000 before the year ends.

Where is ETH Price Headed To?

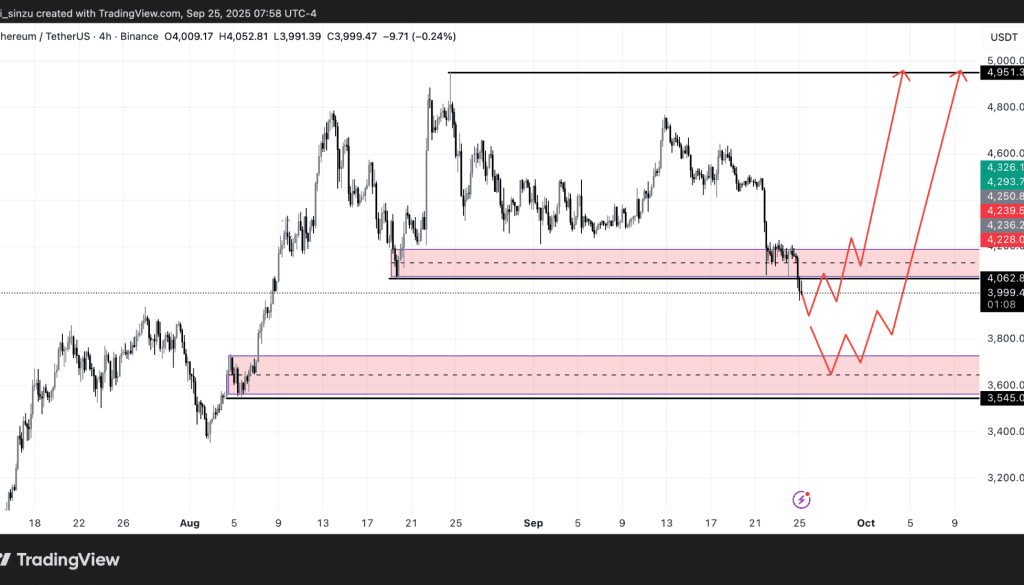

Source – ETH 4H Price Analysis from TradingView

The price of the crypto asset broke to the downside as bulls failed to protect its key zone of $4,100, as the price currently faces an extended price decline towards a key low of $3,700 or a bullish price action, flipping its resistance into support around $4,100 and a bullish price continuation to $5,000.

Despite maintaining a bullish structure in September, a strong close for ETH above $4,000 will spark a fresh rally, potentially driving the crypto market, including altcoins, to new highs. Traders and investors will pay close attention to the price as it approaches the monthly close.

FAQs

Is October a bullish month for crypto?

Historically, October has usually been a good month for the market to rally to the upside.

Is crypto going to rise or fall?

There is strong speculation that the market will rally in October rather than fall, based on past data.

Will Ethereum hit $10,000?

Crypto experts suggest the price could hit $10,000 in the coming months, despite struggling in the last few weeks.

Related Read