Instead of buying and holding bitcoin in a wallet for the price to rise before making a profit, it is possible to engage in bitcoin trading and make gains within a short period. The trading involves trading on how the price of bitcoin moved in the market through the CFD trading. The trader predicts if there will be an increase or decrease in the price of bitcoin and take a position by buying or selling. To trade bitcoin, there are specific steps to follow, which are discussed in this guide.

About Bitcoin Trading

When introduced to cryptocurrencies, the first cryptocurrency that almost every crypto trader knows is bitcoin; however, not all traders understand how to trade bitcoin. The price movement of many cryptocurrencies in the market results from the bitcoin price movement. Bitcoin trading is highly risky due to its high volatility, and there is a possibility of high fluctuations occurring regarding its price. Thus, before trading bitcoin, it is imperative to know how it works and understand the market.

Methods of trading bitcoin

There are two main means that you can carry out bitcoin trading, and they include:

- Using exchanges

- Using a CFD trading account

Using Exchanges

It involved purchasing bitcoin from exchanges and holding on to it to sell when the value increases. However, the unreliability of this method is due to its reliance mainly on the matching servers of the exchanges. Also, the exchanges are susceptible to hacking and theft since many traders will store their Bitcoins on them. Many exchanges got hacked in 2018, like Coincheck losing $534,800,000 and BitGtail losing $195,000,000 to cyber thieves.

Using CFD Trading Account

Traders do not need to buy and hold bitcoin before practicing bitcoin trading by opening a CFD trading account. It requires the trader to speculate on the price movements of bitcoin and use the analysis to take a position in the market. Bitcoin trading is highly volatile. Thus, trading the bitcoin contract of difference is advisable as offsetting losses will be possible. Also, traders will be open to leverage which you can use to make more profits.

A Step-By-Step Guide to Trading Bitcoin

Follow the steps below to start your journey in bitcoin trading:

- Before you can trade bitcoin, it requires opening a bitcoin contract of different accounts, and there are many top exchanges. If you are a newbie, it is preferably to practice with a demo account before opening a live account to prevent you from losing all your funds.

- There are many strategies used in speculating the price movements of bitcoin. Thus, you need to determine the one you will use. With a good strategy, you will know when to enter a bitcoin market and when to exit.

- Define the plan you will use to trade bitcoin after selecting the most suitable trading strategy. When you have a defined trading plan, there will be no deviation issue, and all the decisions you make will be objective. Also, it enhances consistency which is necessary when trading.

- Researching the financial markets for news or information can affect the price of bitcoin, the crypto industry or the country’s economy. Being current with the news help with predicting the future price movements of bitcoin.

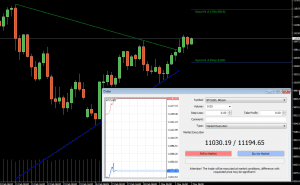

- After confirming the above steps, the next thing is to start bitcoin trading using the data obtained from your market analysis and price movement prediction. It is vital to take note of the lot size and include preventive measures like adding profit and stopping loss. It helps traders minimize their skills, preventing them from losing their assets.

Conclusion

Bitcoin trading is a risky investment, and there is the possibility of losing money no matter how spot-on your market analysis is. Thus, diversification of portfolio is encouraged. Also, trade on exchanges that have high liquidity to enhance quick communication between sellers and buyers. The number of fiat currencies attached as pairs with bitcoin should be numerous.

Traders are enjoined permanently to define their trading plan to prevent them from being inconsistent, which can lead to losses since it will disrupt their trading plan. Using this guide, your journey through your bitcoin trading will be smooth.