Brad Garlinghouse, the CEO of Ripple, says the crypto world is reaching an important moment because big companies are getting more interested in XRP. With new XRP futures ETFs starting up and rules around crypto changing, Ripple is working harder to join regular finance. Meanwhile, people who own XRP are waiting to see what the SEC will do next in their legal fight, as decisions about ETFs could change how the XRP market works.

Crypto ETFs Open Doors – Says Ripple CEO

From a recent segment of Ripple’s “Crypto in One Minute,” CEO Brad Garlinghouse highlighted how crypto ETFs are transforming access to digital assets on Wall Street. He called ETFs “the gateway to financial power,” pointing out that they give institutions a secure and regulated route into the crypto market. This growing interest from institutions is driven by key milestones like the launch of XRP futures and ETFs on major exchanges such as CME and Nasdaq, marking a major step toward bridging traditional finance and the cryptocurrency world.

XRP Spot ETF Approval Hopes Rise

Although more institutional products are becoming available, clear rules from regulators remain uncertain. The SEC is reviewing several applications for XRP spot ETFs from companies including Bitwise, Grayscale, Franklin Templeton, and 21Shares. A key decision is expected by June 17, 2025, specifically for Franklin Templeton’s filing, but Bloomberg’s ETF analyst James Seyffart suggests formal approval may not happen until late 2025.

Even with the delay, optimism around XRP ETFs is growing. Polymarket currently estimates an 83% chance that the SEC will approve a Ripple XRP spot ETF before the year ends. Analysts point out that such an approval could spark a major price increase for XRP, similar to Bitcoin’s 131% rally following the launch of its own spot ETFs.

Building Institutional Trust with RLUSD and ETFs

Garlinghouse views RLUSD and ETFs as key elements in a larger plan to integrate digital assets with conventional financial systems. He pinpointed, “Regulatory alignment will be a core driver of institutional adoption.” Through initiatives like RLUSD and backing XRP ETFs, Ripple is shifting focus from legal challenges toward establishing lasting confidence among banks and financial firms.

With RippleNet connecting more than 300 partners worldwide, the company is using this network to accelerate the use of Ripple’s currency solutions. Also, the wider Ripple exchange ecosystem stands to gain from the growing interest of institutions, especially as ETFs bring new investment into digital currencies.

XRP Price Eyes Boost from SEC and Lawsuit

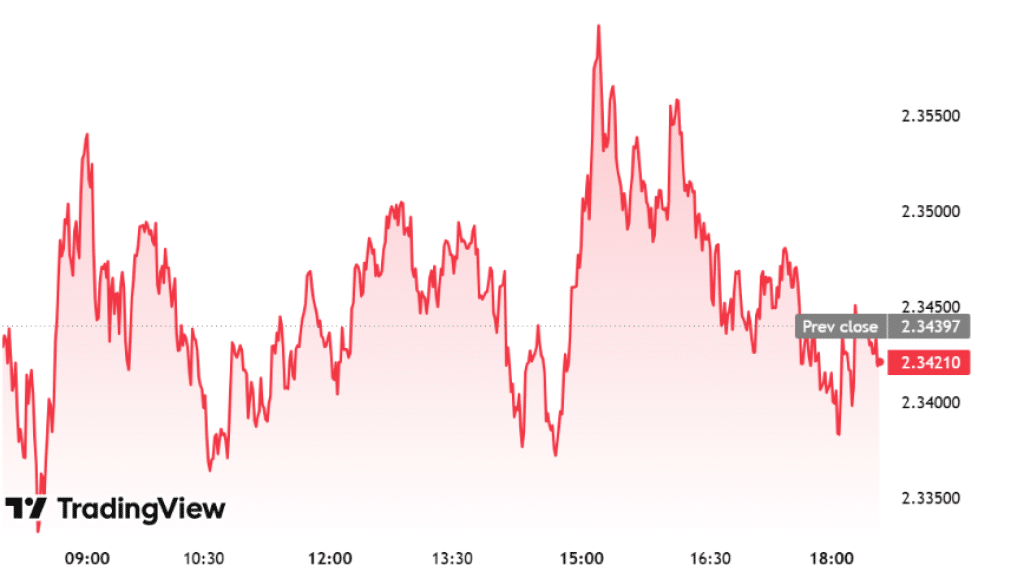

Industry experts are closely monitoring two critical developments: the SEC’s decisions on ETF applications and the final verdict in Ripple’s ongoing lawsuit. Positive outcomes on both fronts could ignite a major rally in XRP’s price, possibly pushing it back up to—or even beyond—its all-time high of $3.55. As of the latest update, XRP was trading around $2.34, marking a 2.29% drop within the last 24 hours.

Final Thoughts

Ripple is at an important point as more big companies show interest in XRP, and new products like ETFs help connect crypto with regular finance. Ripple’s CEO, Brad Garlinghouse, says clear rules from regulators are needed to help banks and big investors feel confident about using XRP. While the SEC’s decisions on spot ETFs and the outcome of Ripple’s lawsuit are still uncertain, many are hopeful that good news could cause XRP’s price to rise, maybe even higher than before. With RippleNet growing and tools like RLUSD, Ripple is getting ready to play a bigger role in digital money if the rules become clearer.