Key Takeaways

- Congressman Matt Gaetz has introduced a bill proposing Bitcoin as a legitimate method for paying federal taxes alongside the US dollar.

- This editorial argues against using Bitcoin for tax payments despite its increasing value. Using appreciating Bitcoin to pay taxes does not make financial sense compared to using depreciating US dollars.

- Although the bill addresses confidentiality and liability issues similar to other payment methods, Bitcoin’s public and transparent nature on the blockchain raises privacy concerns.

Are you considering using Bitcoin to pay your taxes? A new legislative bill suggests that this could become a reality, and taxpayers could soon pay Uncle Sam in Bitcoin. But hold on; it is important to understand the potential risks involved.

In this article, we will explore the bill’s purpose, compare paying Bitcoin and cash for paying taxes, and reveal why there might be better options than paying income taxes with your hard-earned Bitcoin.

Congressman Introduces Bill Allowing Federal Income Taxes To Be Paid In Bitcoin

Recently, Congressman Matt Gaetz has introduced a bill to allow federal tax payments in Bitcoin. The bill aims to make Bitcoin a legitimate payment method for taxes, right next to the US dollar.

If approved, the bill would amend the Internal Revenue Code of 1986, as the new payment method will need to be accommodated. However, specific challenges must still be tackled from a regulatory perspective.

Paying Taxes In Bitcoin Is A Bad Idea

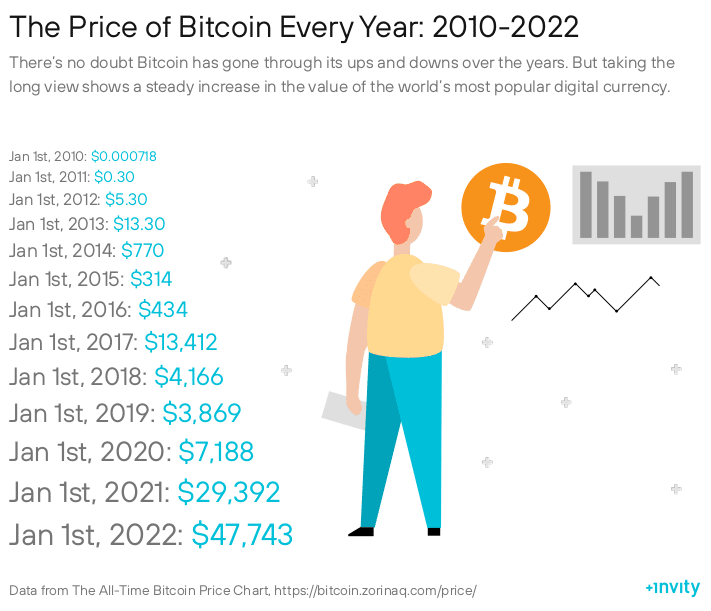

I understand the desire to create mass adoption, but if we look at the Bitcoin chart shown below, we will see that Bitcoin tends to increase in value over time.

Even if we are trading at about $60,000 for one Bitcoin at the time of this writing, that amount has increased significantly since last year.

So, why would you pay your income taxes with something that is appreciating in value?

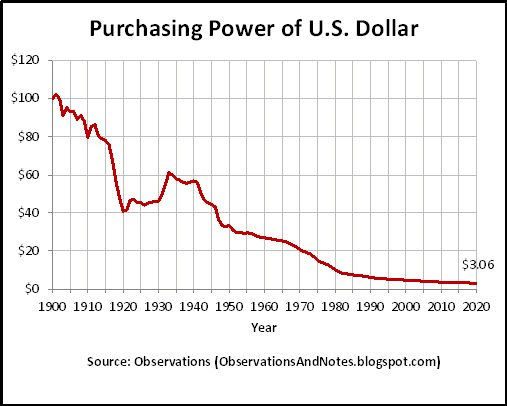

Moreover, if we look at the chart for the purchasing power of the US dollar shown above, we notice that it has continued to decline, and this is due to inflation and other macroeconomic factors affecting the fiat currency.

In addition, there is also a backlash about the bill because taxpayers would have to pay a service fee to use Bitcoin, which is similar to the fee charged if you use your credit card to pay your tax debt.

Privacy Issue

Quoting an excerpt of the article from Decrypt, the legislation “addresses liability and confidentiality issues, applying rules similar to those currently in place for other payment methods, ensuring that the introduction of Bitcoin as a payment option does not compromise existing taxpayer protections.”

However, it is worth noting that the Bitcoin network is very public and open-source, as you can view all the transactions on the blockchain. All you need is a couple of blockchain analytics tools to really figure out who is paying what.

Final Thoughts

I understand the Congressman’s stance on why he is proposing this bill. But then again, I think it is absolutely ridiculous that they want our precious Bitcoin. The government can go ahead and take our fiat, which they destroyed with inflation, which is apparently what they considered “transitory,” but not our Bitcoin.

What are your thoughts about this bill? Will you be using your Bitcoin to pay your income taxes if this bill goes through? Let us know!