Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Gala (GALA) Market Update

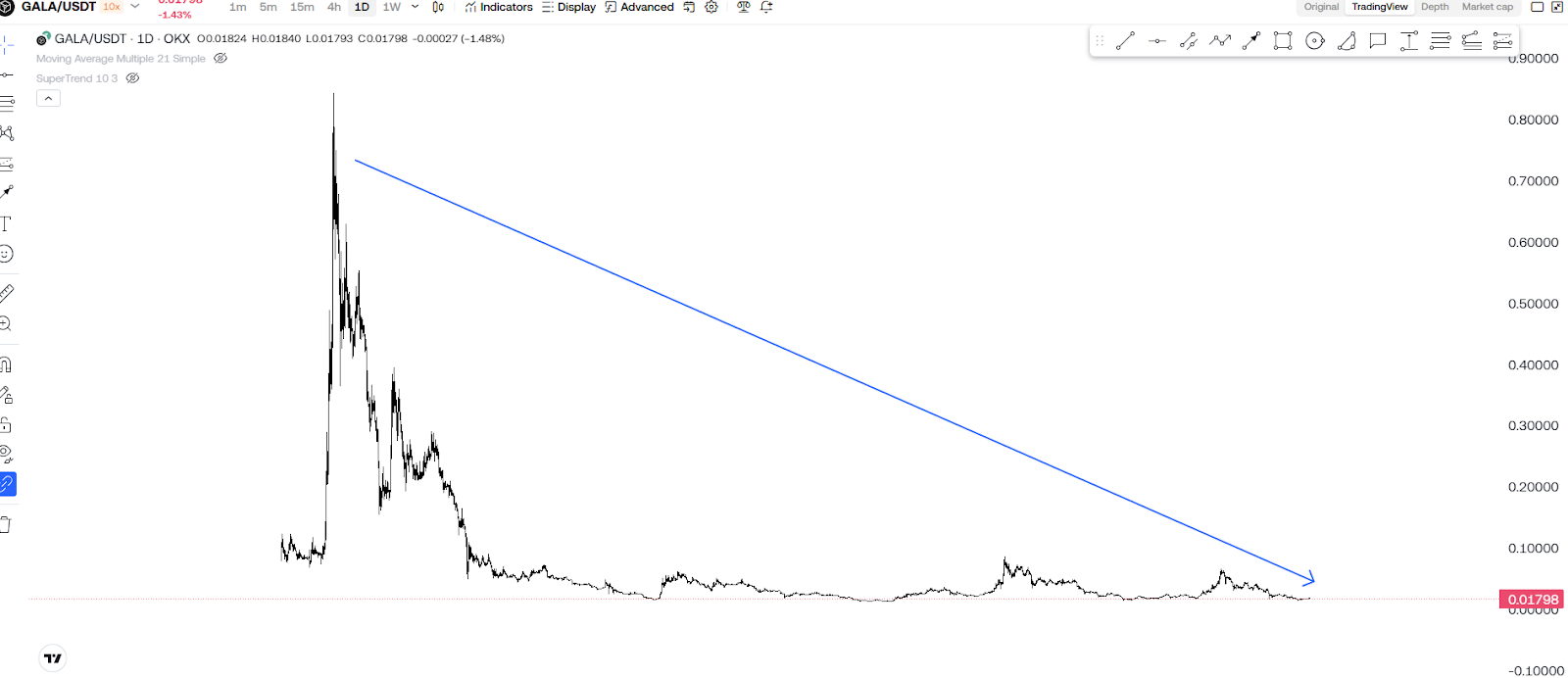

If we look at GALA in a bigger timeframe, it’s clear that we’re still in a downtrend. The overall pattern remains bearish, and we haven’t yet seen a major breakout to confirm a full reversal.

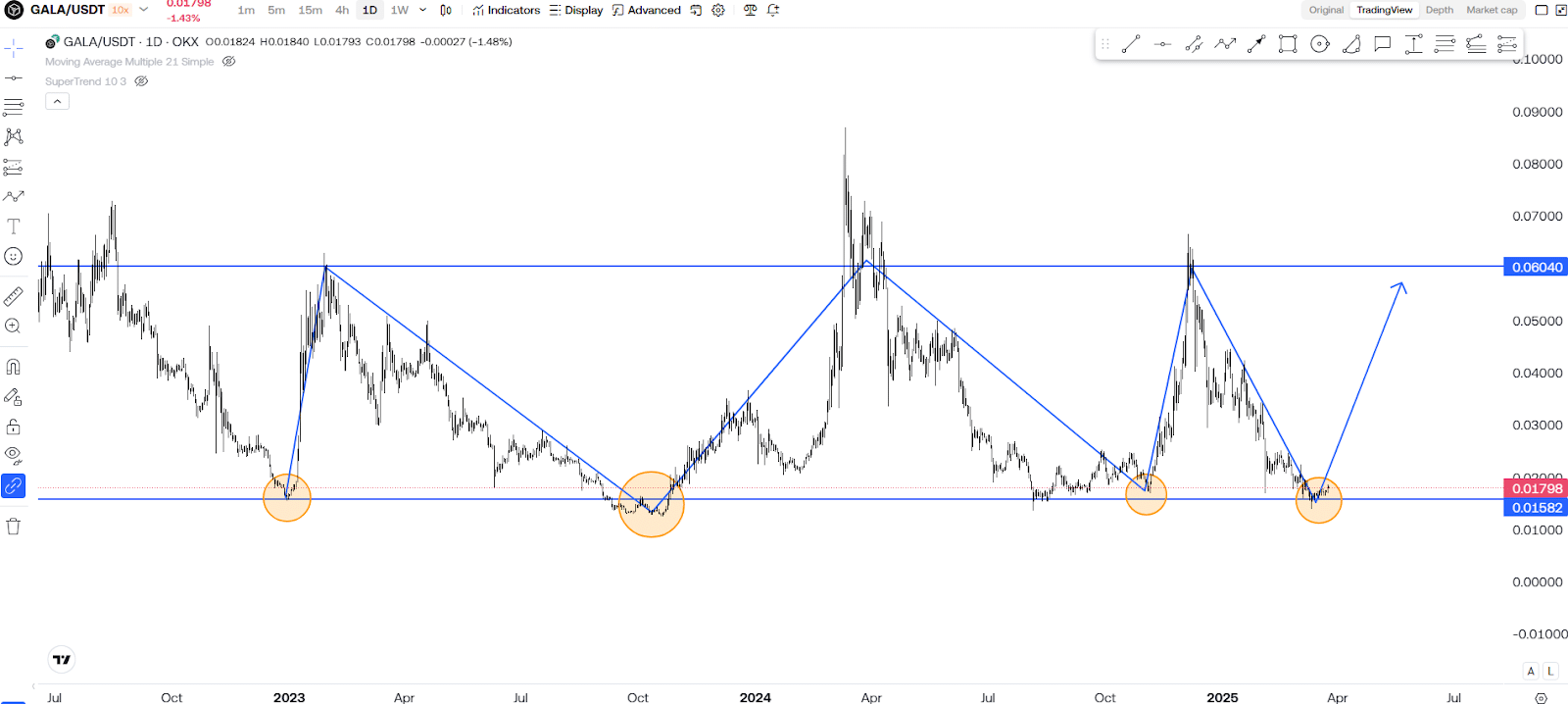

However, if we zoom in and take a closer look, we can see that GALA has been moving sideways for some time. This indicates that sellers are losing momentum, and buyers are starting to accumulate.

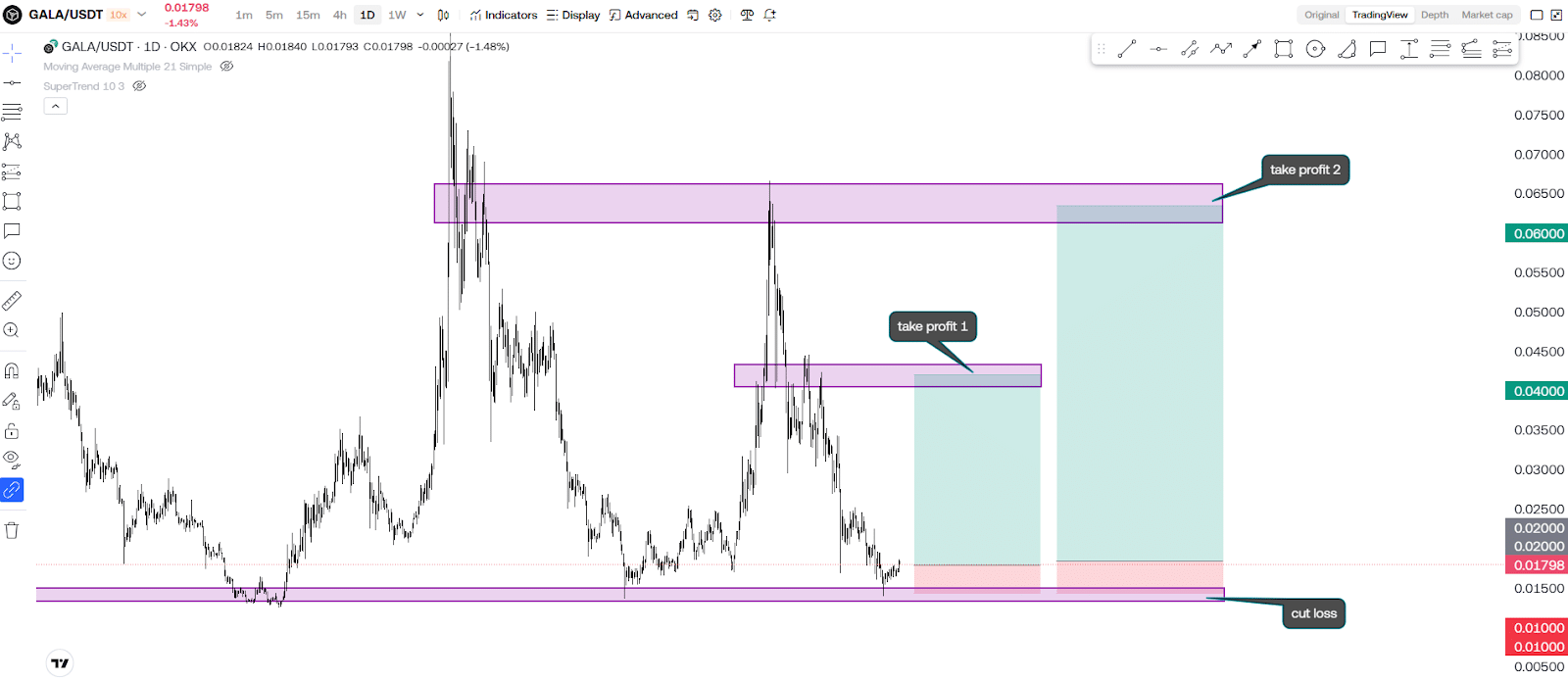

Right now, GALA is sitting around the $0.018 support level. This is an important zone because, historically, every time the price reaches this level, it bounces back up. That means we are currently in a buying zone, where the probability of a price increase is higher than a breakdown. While this doesn’t guarantee an immediate pump, it does suggest that GALA is at a point where buyers could step in again.

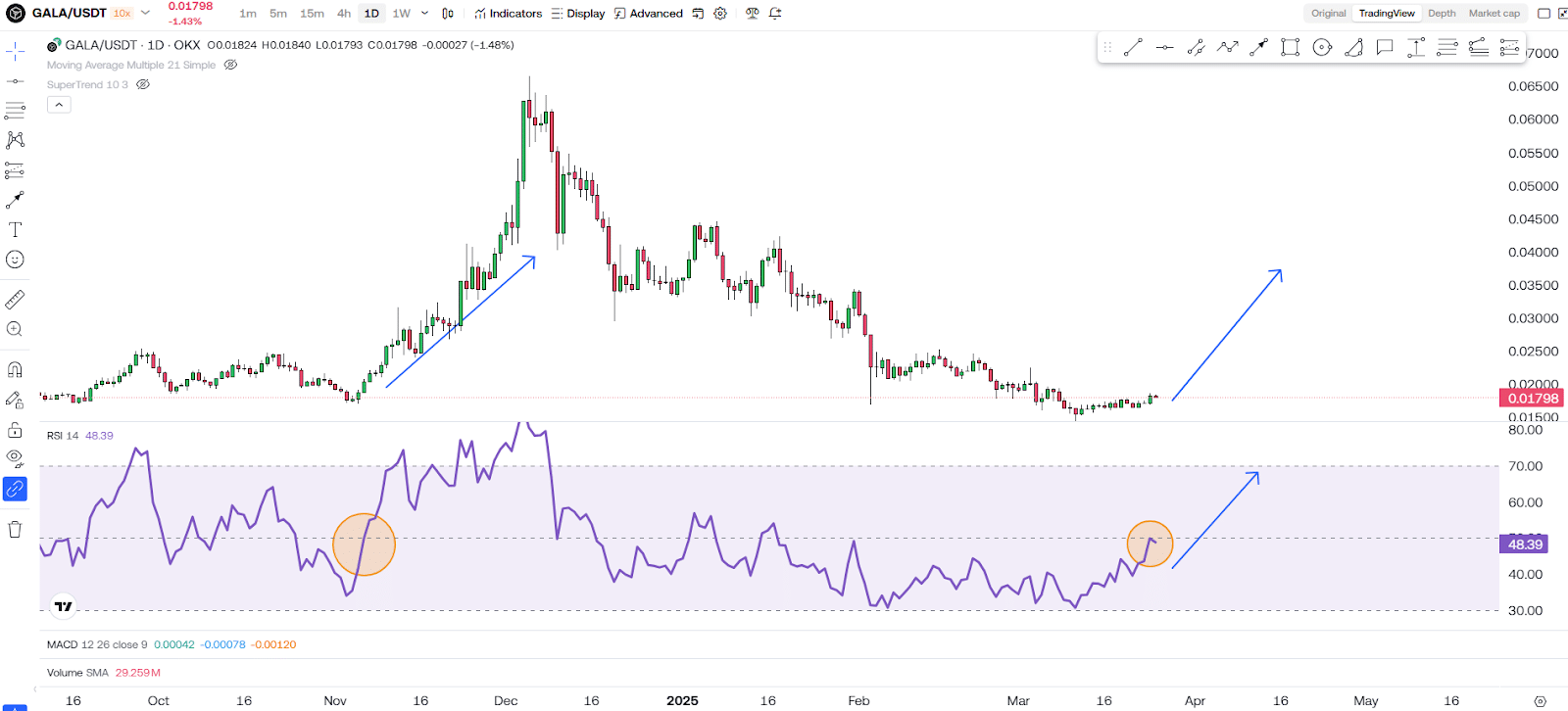

If we analyze the RSI or the Relative Strength Index, we can see that it is slowly climbing above the median line. This is an early signal that momentum is starting to build up. In previous instances, whenever the RSI crossed above this level, it resulted in a short-term price increase. If this pattern repeats, we could see GALA pushing higher in the coming days or weeks.

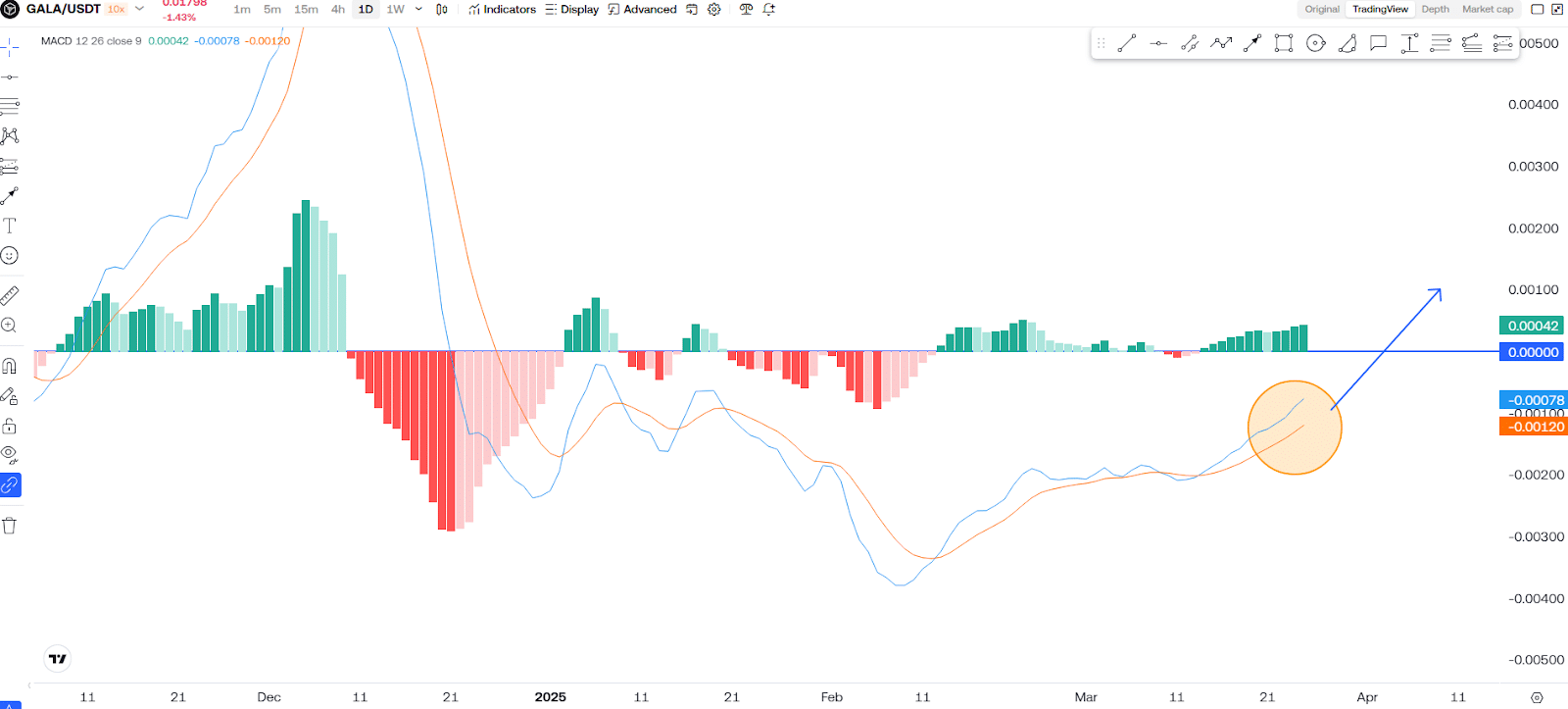

Now, if we look at the MACD or Moving Average Convergence Divergence, we can also see some interesting developments. While the MACD is still in the negative zone, meaning overall momentum is still weak, we can notice that it is slowly climbing upwards. This suggests that a new momentum shift could be around the corner. A bullish crossover of the MACD lines could further confirm that a trend reversal is in progress.

Another key indicator to watch is the moving averages. If we plot the 50-day moving average, which is often used to gauge short-term trends, we can see that GALA has broken above this level. In the past, the price remained below the 50MA for an extended period, which indicated strong selling pressure. However, this recent break above the 50MA could signal that buyers are slowly accumulating GALA, increasing the likelihood of a new trend forming.

For those planning to enter a trade with GALA, it’s important to have a proper risk management strategy. The current buying zone is around $0.018, but it’s crucial to set a stop-loss below $0.017. A break below this level would indicate that the support has failed, and a deeper retracement could follow. This would help protect your capital in case the market moves against you.

When it comes to taking profits, the first take profit level should be set at $0.04. This level has previously acted as resistance, so there’s a high chance that the price could face selling pressure there. If GALA manages to break above $0.04, the next take profit level should be set at $0.06. This level represents a stronger resistance zone, where price rejection could happen again. By taking profits at key resistance levels, traders can secure gains while minimizing risks.

Final Thoughts

Despite the positive signals on lower timeframes, it’s important to remember that GALA is still in a major downtrend when viewed from a bigger perspective. This means that while short-term price movements might look promising, there’s always a risk of another leg down. That’s why it’s crucial to only trade with an amount of money you are willing to risk. The crypto market is highly volatile, and price swings can happen at any moment. Managing risk is just as important as identifying good entry and exit points.

For more in-depth technical analyses like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!