Key Takeaways

- Tether plans to create a stablecoin designed for the US market if the Trump administration improves crypto rules.

- While USDT is the world’s most traded digital asset, it doesn’t currently support the US market.

- Tether CEO Paolo Ardoino believes the new regulatory framework could allow foreign issuers to enter the US stablecoin market.

The world’s leading stablecoin issuer, Tether, will offer a US-only stablecoin if the government introduces improved crypto regulations to encourage new market players’ entrance. Tether, the world’s most traded cryptocurrency, doesn’t currently accept US-based customers.

According to Tether’s Chief Executive Officer Paolo Ardoino, the firm was currently engaging US authorities about the upcoming rules on stablecoins. Unlike regular cryptocurrencies, stablecoins maintain their value by being pegged to real-world assets like gold or fiat currencies, which the US authorities believe are “an important instrument for the United States.”

Implementation of New Rules for Stablecoins

Ardoino stated that, depending on the outcome of their negotiations, Tether could create a token specific to the US market. Currently, the stablecoin issuer has at least 144 billion Tether tokens in circulation. Tether’s stablecoin, USDT, is widely used globally, but US enforcement officials believe it is also popular with international criminal syndicates, an allegation the company denies vehemently.

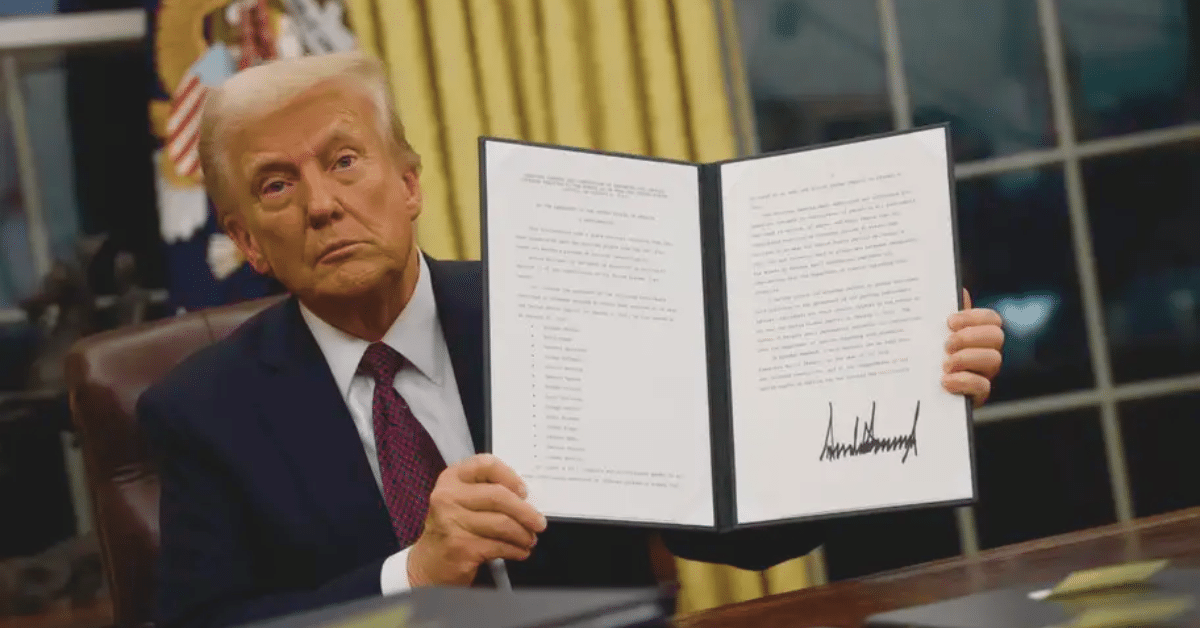

Immediately after his inauguration at the White House, US President Donald Trump embarked on a journey towards fulfilling one of his election campaign pledges: to make America “the crypto capital of the planet.” On January 23, 205, Trump signed an executive order calling for the implementation of new rules for stablecoins to be ready by August. Similarly, the US Securities and Exchange Commission (SEC) has changed its stance and stopped or halted pursuing cases against crypto companies.

Comply With the Local Law Enforcement Regime

The Tether CEO believes the changing regulatory environment is good enough for the company to try and enter the American market. According to him, they look forward to the new rules-making:

“The [US] domestic stablecoins are competitive, there could be an interest from Tether to create a domestic stablecoin in the US […] a settlement currency.”

Stablecoins are designed to act as digital cash that maintains value but is away from the traditional regulated banking system. The anticipated regulations aim to consider whether the US government would coerce overseas stablecoin issuers trading in the US to comply with the local law enforcement regime. Ardoino stated:

“That is something that we [already] do. . . voluntarily”.

He added:

“We are the only ones that on-board the FBI, on-board the US Secret Services. We work directly with the [Department of Justice] and don’t wait for court orders to act, but we have a direct connection with law enforcement.”

Tether Is Gaining Traction

While Ardoino closely watches the progress in Congress as lawmakers debate the long-awaited regulatory framework for stablecoins, the CEO is also concerned about Washington’s broader commitment to dollar supremacy. Ardoino is worried that in addition to the new rules, there was every chance that US policymakers could step back from defending the dollar’s global role at a moment when geopolitical challengers are gaining ground. He stated:

“I believe the biggest threat across the board to the U.S. dollar generally is a digital currency backed by gold.”

Ardoino noted that the presence of Chinese infrastructure projects across Africa and other emerging markets where Tether is gaining traction is evidence of that country’s ambitions to supplant US power.

Conclusion

In the meantime, Tether has its fair share of critics, some of whom are worried about the company’s reserves. The company recently hired a chief financial officer to steer it toward a full financial audit, something the firm hasn’t done for years. For a company that has been hard to persuade large accounting firms to engage with, Tether claims to have involved the Big Four accounting firms. Only time will tell if the anticipated stablecoin rules favor foreign companies’ entry into the market so that Tether and others can become beneficiaries.

Frequently Asked Questions (FAQs)

What is Tether USDT?

Tether is a cryptocurrency pegged to the US dollar; hence, it’s a stablecoin. Tether is the name of the issuing company, and the token itself is called USDT. It was launched in 2014.

How does Tether USDT work?

Since Tether USDT is pegged to the value of the US dollar, the company reportedly keeps monetary reserves of whatever number of USDT coins are circulating, which is how it maintains its value.

Are USDT and Tether the same?

Yes. The token’s name is USD-Tether or USDT. While Tether is really the company’s name, users often interchange these names to refer to the token.