Key Takeaways

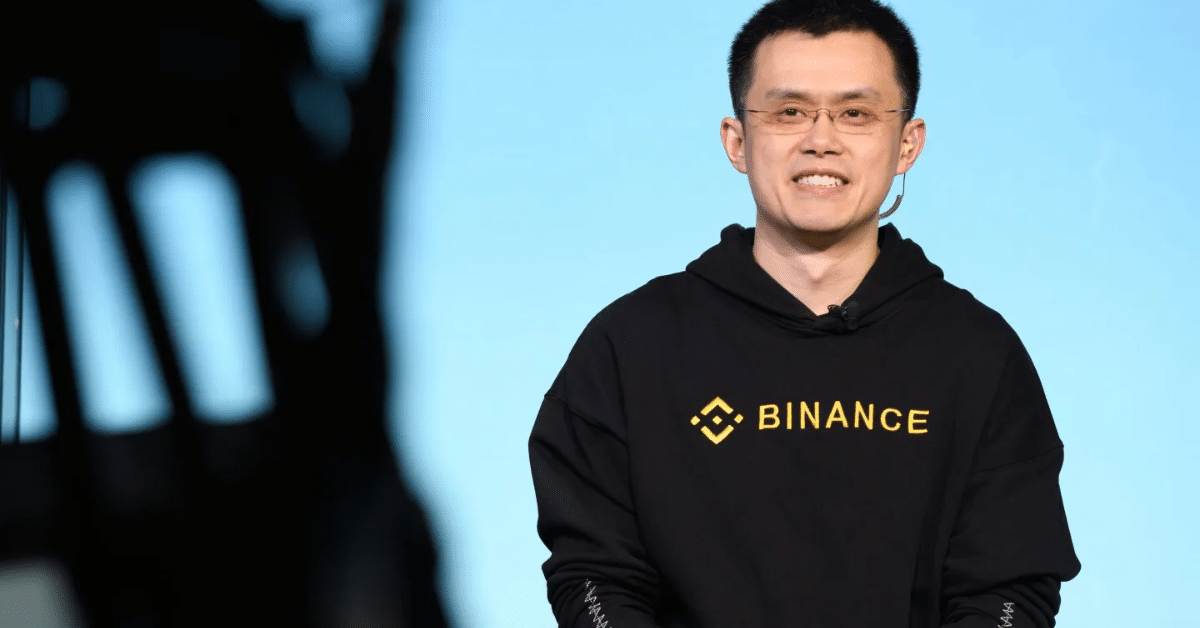

- The US SEC has initiated an unprecedented move in its legal battles seeking to dismiss charges against Binance and its former CEO, Changpeng Zhao.

- The move signals a changing regulatory stance within the US cryptocurrency sector as the SEC navigates new enforcement strategies amidst industry pushback.

- The SEC had previously accused Binance and CZ of operating an unregistered securities exchange, leading to a $4.3 billion settlement with the US government and CZ stepping down as CEO while retaining a significant portion of his wealth.

The US Securities and Exchange Commission (SEC) has formally dropped its lawsuit against cryptocurrency exchange Binance and its founder Changpeng Zhao’ CZ,’’ drawing the curtain on one of the last remaining crypto enforcement actions brought by the regulator.

According to the latest filing in the US District Court for the District of Columbia, attorneys for the regulator and Binance jointly agreed to dismiss the case, which was first brought in June 2023.

Dismissal of the Litigation Is Appropriate

In the original complaint, the SEC accused the cryptocurrency exchange of numerous violations, such as illegally serving US crypto users, commingling customer funds, and inflating trade volumes. Additionally, The SEC accused Binance of unlawfully enabling trading in crypto assets it viewed as unregistered securities. This argument was also used against Coinbase, Kraken, and others under the prior leadership of the SEC. In dismissing the case, the filing stated:

“Whereas, in light of the foregoing, and the exercise of its discretion and as a policy matter, the Commission believes the dismissal of this Litigation is appropriate.”

During the hearing of the case, Binance and Changpeng Zhao pleaded guilty to Bank Secrecy Act violations and agreed to pay over $4.3 billion to resolve a Justice Department investigation. CZ stepped down as CEO, avoiding jail time and retaining much of his wealth. While the SEC hasn’t formally commented on the specifics of the case, litigation releases stated:

“The Commission’s decision to seek dismissal of this Litigation does not necessarily reflect the Commission’s position on any other litigation or proceeding.”

Binance, on the other hand, celebrated the move, with a company’s spokesperson stating:

“The dismissal of the SEC’s case against Binance is a landmark moment […] we’re deeply grateful to Chairman Paul Atkins and the Trump administration for recognizing that innovation can’t thrive under regulation by enforcement.”

Use enforcement for what it was intended for

Under the SEC’s new leadership, the agency has shifted its stance, vacating its previous dalliance with crypto enforcement actions and moving towards engagement and regulatory rollback. It’s held a series of roundtables led by Commissioner Hester Peirce and newly appointed Chair Paul Atkins. Speaking to a crowd during the Bitcoin 2025 Conference in Las Vegas on Thursday, Pierce, who has previously criticized the agency’s previous approach to crypto, stated:

“The goal is to use our enforcement tool for what it was intended to be used for, which is when there are clear rules and people violate them, then we can use our enforcement tool […] it’s certainly not to say that there will not be enforcement. There’s a lot of bad activity, as we all know, that’s perpetrated in the name of crypto.”

Conclusion

The SEC’s latest motion to dismiss its lawsuit against Binance and founder Changpeng Zhao signals a shift in its stance towards the broader cryptocurrency industry. By changing its approach, the regulator could pave the way for a balanced regulatory framework that incentivizes innovation while protecting investors. Industry players will closely monitor how these developments impact the broader cryptocurrency landscape and legislative actions in the months to come.

Frequently Asked Questions

How is crypto regulated in the US?

The regulatory landscape for cryptocurrency in the US is not well-defined and is constantly evolving. Different federal agencies treat digital assets differently based on their assessments of crypto’s characteristics. Lawmakers may weigh in, too, and states can establish their own rules.

Does the SEC regulate cryptocurrency?

The Commodity Exchange Act (CEA) plays a crucial role in regulating cryptocurrency markets, with the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) exercising jurisdiction over different aspects of these markets.

Is crypto monitored by the SEC?

For cryptocurrencies, the SEC evaluates whether token sales or initial coin offerings (ICOs) meet these conditions. If a digital asset is marketed with an expectation of returns based on the issuer’s or a third party’s managerial efforts, it likely falls under securities laws.