Key Takeaways

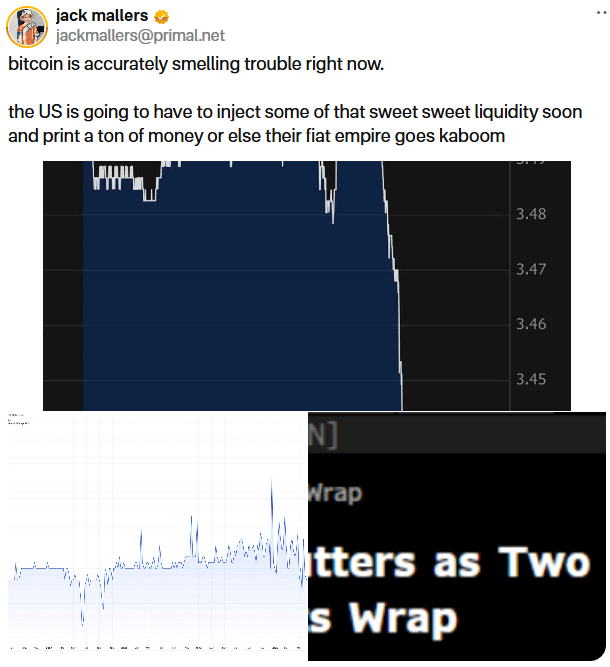

- Strike CEO Jack Mallers argues that Bitcoin is “accurately smelling trouble” in the financial system, acting as a “truth machine” that moves first to price in an impending liquidity crisis.

- Major regional banks like Zions and Western Alliance saw stock plunges due to commercial loan issues, reigniting fears that the 2023 banking crisis was never fully resolved and the system remains vulnerable.

- Mallers predicts the renewed banking stress will force the Federal Reserve to “inject some of that sweet, sweet liquidity” and “print a ton of money,” which he expects will drive Bitcoin’s price significantly higher.

Bitcoin has recently fallen to a four-month low, briefly touching $103,850 before recovering slightly to $107,000. This drop coincided with renewed financial instability among US regional banks, whose stocks are plunging due to problems with bad commercial loans.

Strike CEO Jack Mallers has seized on this confluence of events to reinforce his core belief about the world’s largest cryptocurrency. Mallers took to social media to state, “Bitcoin is accurately smelling trouble right now,” positing that the asset is the most sensitive to liquidity and thus serves as the financial world’s most effective “truth machine.”

He notes that the combination of “Yields are puking, spreads blowing out, and banks are stressed” indicates an imminent systemic problem. Mallers believes this stress is ultimately bullish for BTC, as the necessary government response will be a large-scale injection of liquidity.

US Banking Crisis Redux

Despite government-led bailouts and acquisitions that followed the March 2023 regional banking crisis, fear and vulnerability have returned to the financial sector. The stocks of Zions Bank and Western Alliance, among others, crashed this week due to widespread concern over write-offs on bad loans to commercial customers.

Financial commentators, including The Kobeissi Letter, have argued that the US banking system remains structurally unsound, propped up more by “implicit government guarantees” than by strong financial practices.

This moral hazard, where banks took excessive risks anticipating a government backstop beyond FDIC limits, is cited as the root cause of the persistent fragility. Wall Street’s renewed anxiety suggests the 2023 crisis was merely papered over, not resolved, making the system highly susceptible to a new liquidity shock.

Mallers’ Liquidity Theory

Jack Mallers’ prediction hinges on the Federal Reserve’s inevitable reaction to a growing banking crisis. He argues that the U.S. government will be “forced to print” a large volume of money and “inject some of that sweet, sweet liquidity” to prevent a complete collapse of the fiat empire. Because Bitcoin is the most sensitive and earliest responder to liquidity changes, Mallers believes it will “move first again, and outperform everything” once this money printing begins.

This whole situation is a throwback to the classic narrative: Bitcoin is digital gold, your fortress against governments printing endless money and the constant risk of bank collapses.

This sentiment was forcefully articulated by BitMEX co-founder Arthur Hayes. He views the current decline in BTC price not as a risk, but as a fleeting “sale.” His direct advice to investors with dry powder is to “go shopping,” confidently anticipating that another round of government-led bailouts, like those seen in 2023, will ultimately drive a major rally in crypto markets.

Final Thoughts

The correlation between regional bank stock plunges and Bitcoin’s drop to a four-month low is, according to Strike CEO Jack Mallers, a bullish signal. He sees BTC as an early warning system indicating an impending liquidity crisis that the Fed will be forced to solve with money printing, ultimately sending the Bitcoin price to new highs.

Frequently Asked Questions

Which banks are under renewed stress?

Regional banks, including Zions Bank and Western Alliance, have seen their stocks plunge due to issues with commercial loan write-offs.

What does Mallers mean by Bitcoin “smelling trouble”?

He means Bitcoin’s price volatility is an accurate early indicator of a brewing liquidity crisis in the broader financial system.

What is the expected outcome of the banking stress for Bitcoin?

Mallers predicts the stress will force the Federal Reserve to inject liquidity, which will cause Bitcoin to “move first” and significantly outperform other assets.