Key Takeaways

- Solana (SOL) is a high-performance blockchain platform designed for scalability and speed.

- The crypto project uses a hybrid consensus mechanism combining Proof of Stake (PoS) with Proof of History (PoH) for faster transaction validation.

- SOL supports a growing ecosystem of decentralized applications (dApps) in DeFi, NFTs, and other areas in the crypto sector.

There are many cryptocurrencies in the market, but Solana (SOL) was one of the top coins in 2021. This virtual currency was able to reach a large number of users, and several projects have been working on different solutions on top of this blockchain network.

In addition, Solana became one of the top 5 cryptocurrencies. This shows that there has been a large adoption and interest in this coin. But what is Solana (SOL) all about? What is this blockchain network offering that other projects are not currently able to offer? We will tell you all the details about Solana in this guide.

What Is Solana (SOL)?

Solana is a cryptocurrency and blockchain network that aims to offer advanced and efficient decentralized finance (DeFi) solutions. Its goal is to offer better solutions than the current blockchain networks in the cryptocurrency market.

Over the last few years, we have seen how layer-1 blockchains have been affected by scaling issues. Fees became very high, and transaction times were also massively long for users who did not want to pay high transaction fees. Due to this, DeFi and other blockchain initiatives searched for different solutions to deploy their projects.

Solana became one of the most efficient networks, facilitating the creation of different decentralized applications. The goal is to improve scalability and enable all projects to release and deploy their smart contracts on top of that network.

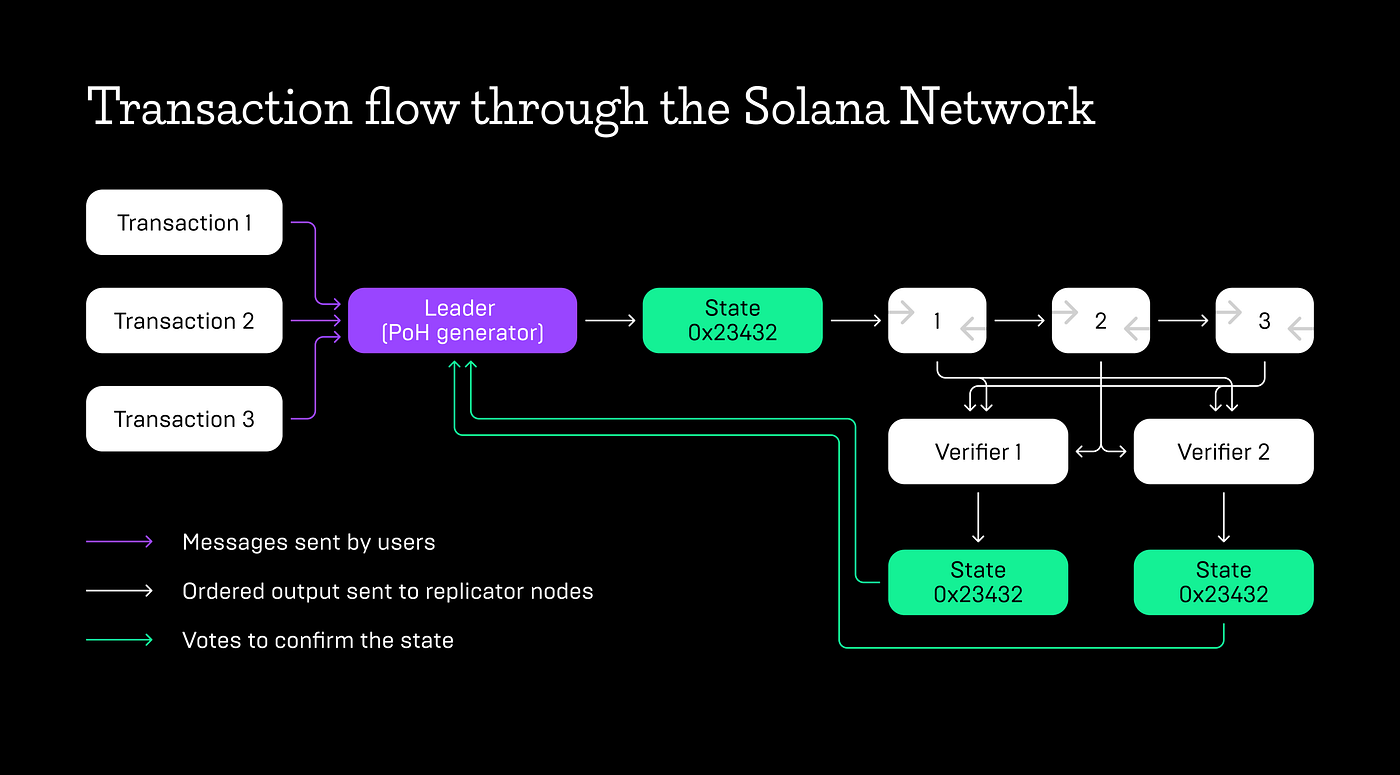

This blockchain network works with a unique Proof-of-History (PoH) consensus algorithm that also relies on Proof-of-Stake (PoS) solutions. In this way, Solana allows network participants to deploy, handle, and interact with different smart contracts, dApps, and decentralized finance solutions.

Thanks to its hybrid consensus algorithm model, Solana offers some of the most reliable and fast blockchain solutions in the cryptocurrency market. Users should not be worried about the lack of scalability or high fees; Solana is nowadays one of the best and most efficient blockchain networks in the cryptocurrency market.

At the time of writing this article, Solana is working with more than 400 projects from all over the world. In the future, this number could continue growing, as the goal is to onboard as many projects as possible to use and enjoy fast transaction speeds, low fees, and efficient smart contract deployment.

Thanks to its network of global validators, Solana is a decentralized network that is fully censorship-resistant, which is very important for crypto and market participants. In this way, companies and individuals that deploy smart contracts on top of Solana can be sure that their transactions will be processed and that a centralized authority will not control them.

How Does Solana (SOL) Work?

Solana (SOL) functions with a unique blend of technologies to achieve its speed and scalability goals. Here’s a breakdown of the project’s key aspects:

Proof-of-Stake (PoS) And Proof-of-History (PoH)

Solana relies on a Proof-of-Stake (PoS) consensus mechanism to secure the network. Validators who stake SOL tokens are responsible for verifying transactions. Those with more staked SOL have a higher chance of being chosen to validate a block.

For Proof-of-History (PoH) however, this is where Solana gets interesting; PoH tackles the challenge of ordering transactions efficiently. Validators create a continuous record of timestamps cryptographically, called a clock. Transactions are tied to these timestamps, allowing validators to agree on the order without complex calculations. This significantly speeds up transaction processing.

High-Performance Architecture

Solana utilizes custom hardware and software optimizations to streamline transaction processing. Validators run specialized nodes that can process transactions parallel to each other, unlike the sequential approach in some blockchains. This parallel processing further contributes to Solana’s high transaction throughput.

Blockchain Clock

Solana’s PoH creates a verifiable timeline of events. This timeline acts like a global clock for the network, ensuring all validators are on the same page regarding transaction orders. This eliminates the need for complex communication between validators, further boosting efficiency.

Solana (SOL) Token And Tokenomics

Tokenomics

The SOL token is Solana’s native cryptocurrency. It is used for:

- Transaction Fees

- Staking

- Governance

Token Details

Total Supply ∞

Circulating Supply 461,803,729 SOL

Current Price $143.25

Market Capitalization $66,180,028,300

This information is current as of August 2nd, 2024, and the token’s price, market value, and available supply may fluctuate.

Distribution

- Seed Sale (15.86%)

- Founding Sale (12.63%)

- Validator Sale (5.07%)

- Strategic Sale (1.84%)

- Public Auction Sale (1.60%)

- Team (12.50%)

- Foundation (12.50%)

- Community Reserve (38.00%)

It is important to note that SOL has an uncapped maximum supply but with a disinflationary emission rate. This means new tokens are created over time but at a decreasing rate. The current circulating supply is expected to reach around 700 million SOL tokens by January 2030.

Where Can I Buy Solana (SOL)?

Binance – Binance is a major exchange offering a wide range of cryptocurrencies. It offers multiple ways to buy crypto, including credit cards, debit cards, and peer-to-peer (P2P) trading.

Bybit – This exchange is known for its derivatives and margin trading features, but you can also use the platform for spot trading.

Coinbase – Coinbase is an American-based cryptocurrency exchange that allows you to buy cryptocurrencies using various payment methods, including bank transfers, debit cards, and wire transfers.

Is Solana (SOL) A Good Investment?

Pros

- Speed – Solana boasts very fast transaction processing speeds, with the ability to handle tens of thousands of transactions per second (TPS) compared to Ethereum’s current throughput of around 15-30 TPS.

- Thriving Ecosystem – Solana has fostered a rapidly growing ecosystem of decentralized applications (dApps), including those in DeFi (decentralized finance), NFTs (non-fungible tokens), and Web3 development. This rich ecosystem attracts developers and users to the platform.

- Ecosystem Boom – The Solana ecosystem has been flourishing, attracting developers to develop dApps, DeFi projects, and NFTs, fueling excitement.

Cons

- Network Outages – Solana has experienced several network outages in the past, raising concerns about its reliability and stability.

- Centralization Concerns – In its early stages, Solana received significant investment from Venture Capital (VC) firms. Some argue that this concentrated ownership by VCs could lead to manipulation of the network or the token’s price.

- Tied To FTX In The Past – The collapse of the FTX cryptocurrency exchange in November 2022 significantly impacted Solana. FTX was a major backer of the project, and the two platforms were closely linked.

Final Thoughts

Whether Solana (SOL) is a good investment depends on your risk tolerance and goals. Remember, this guide only provides a starting point for your research. Always conduct your due diligence before making any investment decisions.