Key Takeaways

- According to Nakamoto CEO David Bailey, the digital asset treasury narrative is being “muddled” by companies that add “failed altcoins” and “toxic financing” to their balance sheets.

- The comments highlight a growing philosophical divide between companies that see Bitcoin as a singular treasury asset and those that are exploring a broader range of cryptocurrencies.

- This trend, fueled by “narrative-driven theses,” is being tested, with some analysts predicting a “death spiral” for companies that are poorly executing their treasury strategies.

The narrative around digital asset treasuries is becoming increasingly complex and “muddled,” according to David Bailey, CEO of Bitcoin treasury company Nakamoto.

His comments come as more publicly traded companies are looking beyond Bitcoin to add a diverse range of cryptocurrencies to their balance sheets.

The Evolution of the Treasury Narrative

The original “Bitcoin treasury narrative,” pioneered by companies like MicroStrategy, was centered on a single, core thesis: Bitcoin is the most secure, decentralized, and inflation-resistant asset to hold on a corporate balance sheet.

The strategy was to convert a company’s cash reserves into Bitcoin as a way to hedge against monetary debasement and create a long-term store of value. However, this narrative has evolved. As the crypto market has matured, many companies are now looking “down the risk curve” to add other assets.

These “narrative-driven theses,” as noted in a recent report from Galaxy Digital, have led to companies holding tokens like Ether, Solana, XRP, and even HyperLiquid (HYPE) in their treasuries.

While this diversification could be a way to generate income (as with staked Ether) or capitalize on specific market trends, Bailey and others argue that it dilutes the core message and risks the company’s financial stability.

The Test of the Treasury Sector

According to Bailey, the entire digital asset treasury sector is “being tested.” He believes that companies that execute their strategy well—by building and monetizing their balance sheets effectively—will thrive.

Conversely, he warns that those that execute poorly will “trade at a discount and be consumed by someone who can do it better.”

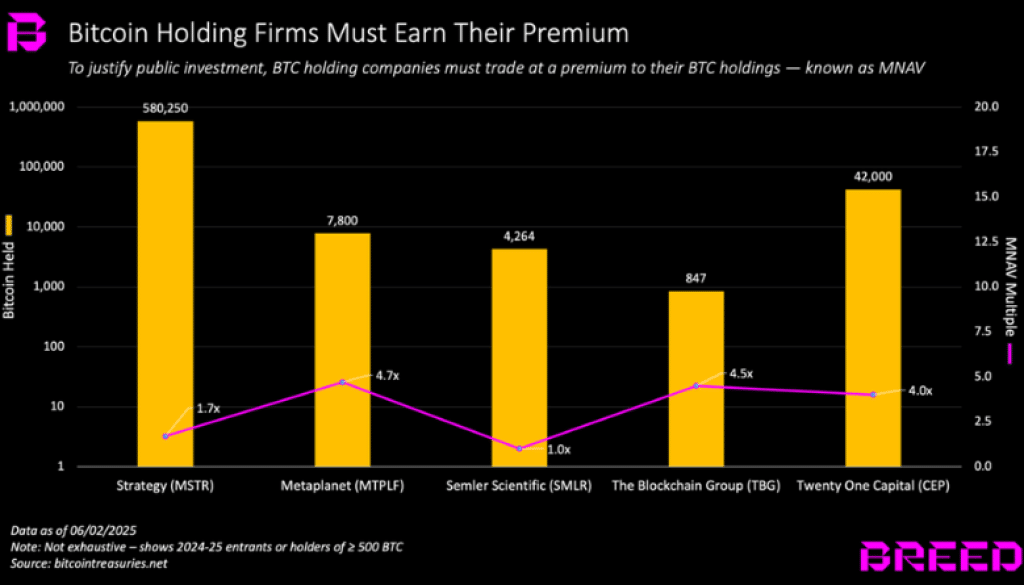

Venture capital firm Breed, has warned that many of these firms could face a “death spiral” if they continue to trade close to their net asset value (NAV).

A “death spiral” refers to a vicious cycle where a company’s stock trades at a discount to its assets, making it harder to raise capital and forcing it to sell its assets at a loss, further depressing its stock price.

This risk is even greater for companies holding volatile and less-liquid altcoins.

Final Thoughts

David Bailey’s comments are a vital contribution to the ongoing debate about the future of corporate crypto adoption. While the trend of companies adding digital assets to their treasuries is undeniable, the question of which assets and why remains.

Frequently Asked Questions

What is a “digital asset treasury company”?

A digital asset treasury company is a publicly traded firm that holds a significant amount of cryptocurrencies on its balance sheet as a core part of its business strategy.

Why does David Bailey believe the narrative is “muddled”?

Bailey believes the narrative is “muddled” because companies are adding “failed altcoins” and using “toxic financing” to fund their acquisitions, which he argues dilutes the original Bitcoin-focused strategy.

What is a “death spiral” for a treasury company?

A “death spiral” is a vicious cycle where a company’s stock trades at a discount to its net asset value (NAV), making it harder to raise capital and forcing it to sell its assets at a loss.