Key Takeaways

- Poland’s parliament (Sejm) approved the Crypto-Asset Market Act, introducing a licensing regime aligned with the EU’s MiCA regulation.

- The bill introduces criminal liability for violations, including fines up to $2.8 million and potential prison terms of up to two years.

- Critics, including politicians, warn the “overly restrictive” law, overseen by the slow KNF regulator, could “destroy” the Polish crypto market.

Sejm Approves MiCA-Aligned Crypto-Asset Market Act

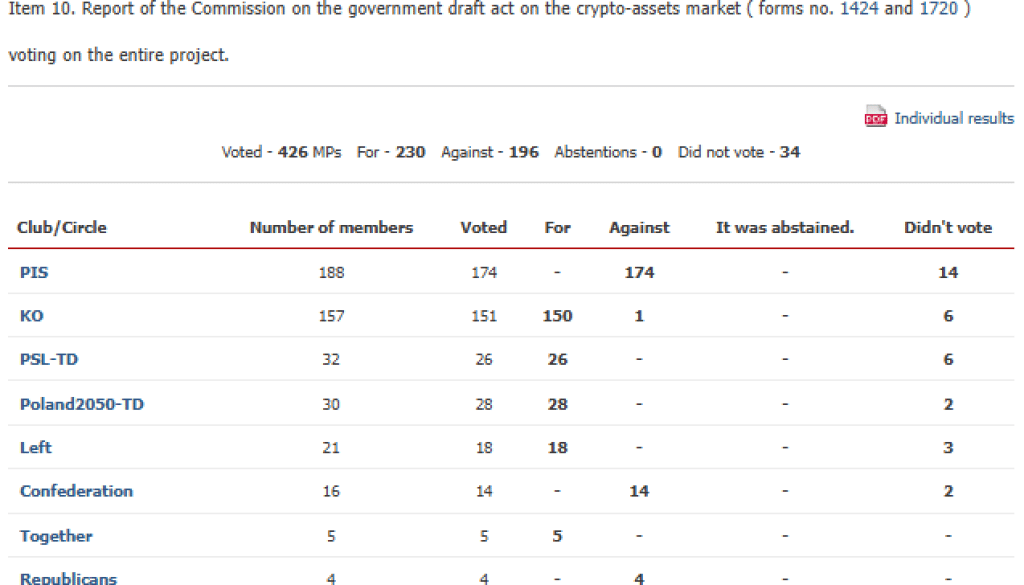

Poland’s lower house of parliament, the Sejm, has passed the controversial Crypto-Asset Market Act, marking a significant step in regulating the country’s digital asset industry. The legislation is designed to harmonize Poland’s framework with the European Union’s comprehensive Markets in Crypto-Assets (MiCA) Regulation.

Key to the new law is the establishment of a mandatory licensing regime for all Crypto Asset Service Providers (CASPs)—including exchanges, custodians, and issuers, both domestic and foreign—who wish to operate within Poland.

The Polish financial supervision authority, the Komisja Nadzoru Finansowego (KNF), has been designated as the primary regulator responsible for overseeing the market and granting these licenses.

Concerns Over Restrictive Provisions and KNF Oversight

Despite the aim of regulatory alignment, the bill has ignited a strong public and political backlash due to its perceived severity and restrictive nature. Critics point to the introduction of substantial criminal liability for non-compliance, which includes heavy fines reaching up to 10 million Polish zlotys ($2.8 million) and even prison sentences of up to two years.

Some opposition lawmakers have labeled the Polish implementation as “the largest and most restrictive cryptocurrency law in the EU,” warning that this “overregulation” could stifle innovation and endanger the country’s three million crypto holders.

A major concern is the role of the KNF, which has been described as “the slowest-acting regulator in the EU,” with application processing times averaging 30 months.

This bureaucratic bottleneck, critics argue, could effectively lead to the “destruction of blockchain and stablecoins” in Poland. The bill now proceeds to the Senate, with some urging the Senate and the President to veto the legislation.

Final Thoughts

Poland’s drive to implement the MiCA framework is commendable for establishing clear rules, but the severity of the criminal penalties and the restrictive licensing process overseen by a slow regulator pose a significant threat. The final verdict rests with the Senate and President, who must balance regulatory safety with market innovation.

Frequently Asked Questions

What is the main goal of the new Polish crypto law?

To implement the European Union’s Markets in Crypto-Assets (MiCA) regulation, primarily by establishing a mandatory licensing regime for all crypto service providers (CASPs).

What are the main penalties for violating the new law?

Fines up to 10 million zlotys ($2.8 million) and potential prison sentences of up to two years.

Why are critics concerned about the Polish law’s implementation?

They fear the law is overly restrictive (gold-plating MiCA), and the slow-moving KNF regulator will create an unbearable bottleneck, potentially driving crypto firms out of the country.