Key Takeaways

- High-profile investor Jeffrey “Machi Big Brother” Huang sold his entire $25.8 million Hyperliquid (HYPE) position at a $4.45 million loss, citing concerns over the token’s upcoming vesting schedule.

- The sale follows a similar exit by other large investors and occurs as Hyperliquid’s HYPE market share in the decentralized exchange (DEX) space has fallen sharply to rising rivals.

- The shift in capital from HYPE to competitors like Aster and Lighter signals a growing sense of investor uncertainty and an intensifying competition within the decentralized perpetuals market.

In a move that underscores the growing investor unease around the Hyperliquid ecosystem, high-profile investor and celebrity Jeffrey “Machi Big Brother” Huang has sold his entire $25.8 million HYPE position at a realized loss of $4.45 million.

The On-Chain Signal of an Investor Exodus

Jeffrey Huang, known as “Machi Big Brother,” is a well-known figure in the crypto space, with a reputation for bold, high-stakes bets. His on-chain actions are often closely watched by the community as a signal of market sentiment. His decision to sell his HYPE tokens at a significant loss, rather than hold for a potential recovery, speaks volumes about his long-term outlook on the project.

The move signals that even a seasoned investor is unwilling to face the “Sword of Damocles” — the impending token unlock that is expected to introduce a massive supply of new tokens into the market.

Analysts from BitMEX co-founder Arthur Hayes’ family office fund, Maelstrom, have warned that the HYPE token’s upcoming vesting schedule will be its “first true test.”

The schedule, which begins on November 29, will distribute an estimated $11.9 billion worth of HYPE tokens to team members over a 24-month period.

A DEX Market in Flux

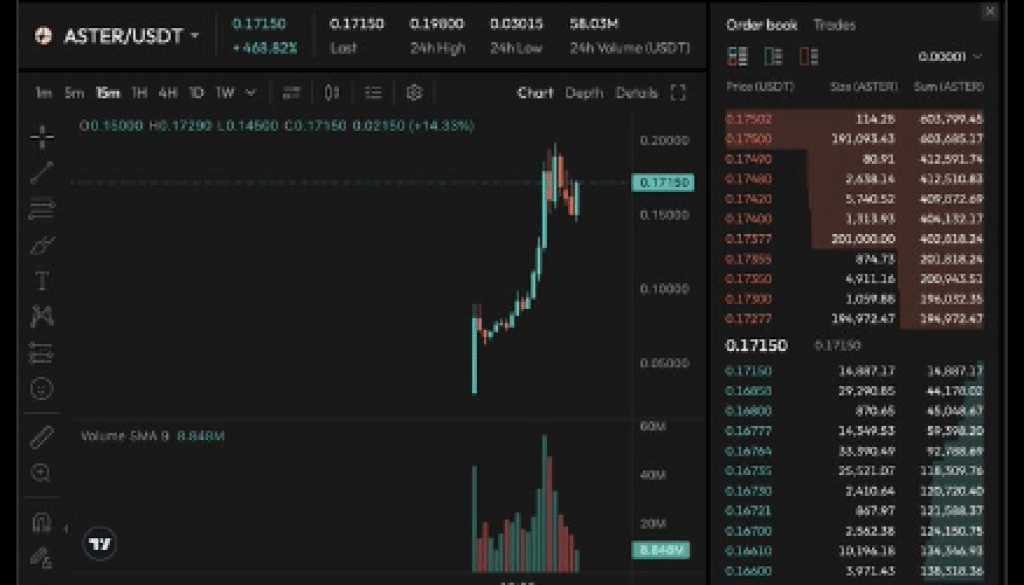

The investor exits are not happening in a vacuum; they are occurring as the decentralized exchange (DEX) landscape undergoes a significant shift. Hyperliquid’s HYPE perpetual futures market share has fallen sharply, dropping from a high of 65% in mid-July to just 33% on Tuesday.

Hyperliquid’s HYPE loss of market share is directly benefiting its rivals. During the same period, Aster, a decentralized perpetuals exchange linked to Binance co-founder Changpeng Zhao, saw its market share rise from 1.3% to 20%, while Lighter’s share climbed from 12.8% to 17.1%.

Aster’s brief crossing of the $2 billion Total Value Locked (TVL) milestone further validates its position as a serious competitor. As the DEX sector evolves, platforms that can address challenges like sustainable liquidity and cost efficiency will likely emerge as the new leaders.

Final Thoughts

The HYPE token’s recent struggles underscore the fragile nature of market leadership in a rapidly evolving space. The exits of influential figures like Arthur Hayes and Machi Big Brother, combined with a sharp decline in market share, signal a critical turning point for the Hyperliquid ecosystem as it prepares for its biggest challenge yet.

Frequently Asked Questions

What is the Hyperliquid (HYPE) token unlock?

The HYPE token unlock is a vesting schedule that will begin on November 29, distributing nearly $12 billion in tokens to core contributors over a 24-month period, potentially creating significant sell pressure.

What is “Machi Big Brother”?

“Machi Big Brother” is the online alias of Jeffrey Huang, a Taiwanese music celebrity and high-profile digital asset investor known for his large, on-chain cryptocurrency bets.

What is a “DEX” market share?

DEX market share refers to the percentage of total trading volume or activity that a particular decentralized exchange (DEX) commands within its specific market, such as decentralized perpetual futures.