Cryptocurrency 101 – If you’ve been keeping up with the latest trends in the financial industry, then you’ve probably heard of the rise of cryptocurrency – the latest innovation in financial technology. The digital currency is said to have the potential of disrupting the global economy and its speculative nature has been debated by many camps; and yet, there are still a ton of people willing to try their hand on it.

So what’s the deal with cryptocurrency? Why is there such hype about it and should you invest in it? Well, before you get into the nitty-gritty of the cryptocurrency market, it’s important to know the basics. Let’s start simple. What is cryptocurrency 101? Where does its name come from? When did it emerge, and what are its applications? Let’s find out.

What is Cryptocurrency 101

Cryptocurrency is a digital currency. It is built with cryptographic protocols that make this digital currency secure. This type of currency is not controlled by any central point, making it immune to interference by the government or other entities. The processes under this require the approval of all entities involved for it to be successful. It also prevents the tendency for overspending. Transactions made with crypto is easier because the process only requires participants’ public or private keys. Unlike any other process conducted in traditional financial institutions, the transaction fee is minimal.

That is cryptocurrency in a nutshell. After you‘ve read it, you‘ll know more than the average layman.

Interesting: Cryptocurrency Affiliate Programs

How did it come about?

The years 1998-2009, was a time for several attempts on the creation of online currencies based on secured encryptions. Worth mentioning are B-Money and Bit Gold which eventually did not come to pass. Satoshi Nakamoto, the unknown inventor of cryptocurrency, planned to make a peer-to-peer network of digital cash sharing without a central entity controlling it. Bitcoin was made available to the public for the very first time in early 2009.

Interesting: Cryptocurrency Mining: Different Methods

In 2010, a Bitcoin holder offered 10,000 of them in exchange for two pizzas. This is when the currency was assigned values and used for trading. If this person had not traded his/her Bitcoins for two pizzas, it would have been worth $100 million today.

Learn more: Cryptocurrency Trading: How to Invest in Coins

Where can I use it?

Purchase of goods and services

Electronics, household and kitchen items, pet supplies, and even food can be purchased through cryptocurrency. Overstock.com provides a number of products that you can buy through Bitcoin. You can purchase electronics, household items, and even furniture in this shop. You can also visit Cryptopet and it has a wide range of choices for your pets in exchange of cryptocurrencies. You can even eat in KFC Canada and pay via Bitcoin. Isn’t that great?

Money transfers

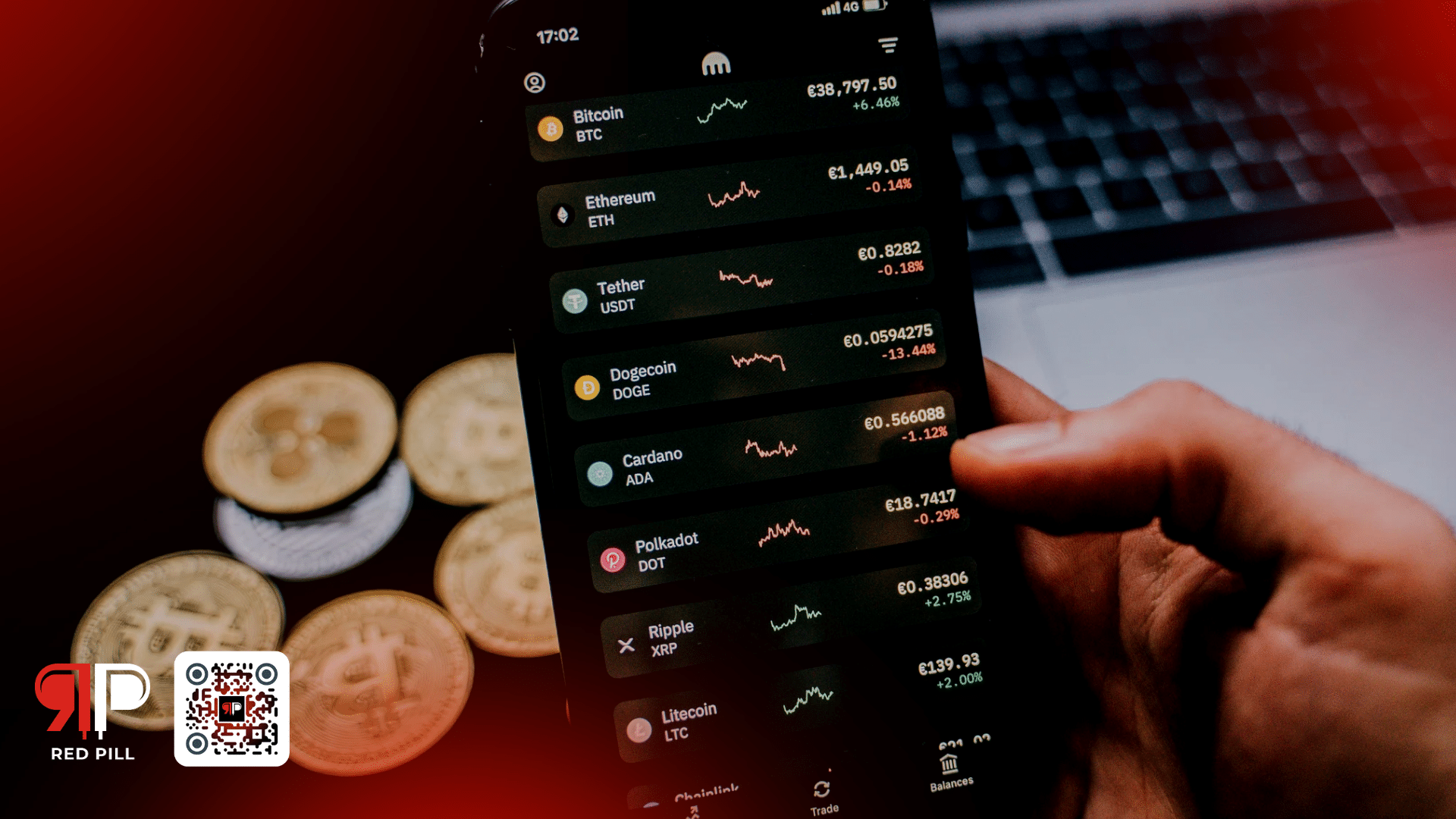

Cryptocurrencies are known for their convenience in money transfers. These are done with high speed and at low cost which makes it well-known among its users. Digital currencies such as Bitcoin (BTC), Litecoin (LTC), Stellar (XLM), Ethereum (ETH), Ripple (XRP), Dogecoin (DOGE), Tron (TRX), Polkadot (DOT), NEM/XEM, or Bitcoin Cash (BCH) are often used in these kinds of transaction, especially for international exchanges.

Other coins: Libra, Aave, Cake, Sushi, 1inch, SOL, FTT, ADA (Cardano), UMA, MobileCoin, Bytecoin, Aelf, Numerarie (NMR), Shiba Inu, Elongate, GME, wETH, Chia, Celer

Learn more: 8 Best Cryptocurrency Wallets for Your Coins

For investment in startups

Initial coin offerings (ICO) gives startup businesses an opportunity to raise capital through cryptocurrencies such as Bitcoin or Ether. They usually sell newly created products or projects with tokens. Tokens are used as a means to measure the success or failure of the startup.

Private transactions

Monero (XMR), ZCash (ZEC), and PIVX allows users to make anonymous financial transactions. This means that the users to proceed with their transactions without the usual questions such as to whom you are sending money to, why send a large amount of money, and what are your sources of funds.

Non-cash remittances

Recently, a Nigerian blockchain startup SureRemit was created to allow non-cash remittances in different parts of the world, especially African regions. This gives the receivers top up data or utility payments by the sender.

Get paid to post

Do you blog? Steemit, the very first incentivized blogging platform, gives you a chance as a writer to receive cryptocurrency by creating quality content. This allows different users to contribute to the platform and be rewarded immediately.

Travel

You can also satisfy your wanderlust with crypto. Cheapair, Expedia, and Destinia lets you book flights, car rentals, and hotels through Bitcoin or Ether. If you are on a budget and want to just rent an apartment unit, you can use Cryptocribs for this type of transaction. Travelers can now also convert their cryptocurrency into local money in different parts of the world.

Interesting: The Basics of Cryptocurrency Gambling

Why has it become significant?

Cryptocurrency has been touted as money of the future. If you are concerned about convenience and privacy, this might be an option for you. It uses secure technology and works through a blockchain distributed among its members.

Unlike a centralized system which may collapse if the central node is attacked, the blockchain goes on as long as the members use and believe in it. As long as it remains useful, it will continue to evolve and develop with its user base.

Learn More: What is DeFi? (Decentralized Finance)

What are the issues surrounding it?

As cryptocurrency gains popularity, there are also emerging issues surrounding this. You can read about some of them below.

Price manipulation

One of the most popular issues in cryptocurrency is its volatility. Value changes through time and is reflected differently in different cryptocurrency exchange platforms. This is usually caused by “whales” or those who are large cryptocurrency shareholders. They are able to manipulate the price of cryptocurrency which eventually swings the market. They use the buy and sell processes in order to gain. Since they have the power, some of these whales just operate the price values without investing.

Used by cybercriminals

This also allows for hackers and cybercriminals to hack the systems surrounding cryptocurrencies and facilitate heists which results to the loss of millions among its users. This results to a significant change in market exchange as well as the loss of investors. Moreover, since this uses a blockchain system, stolen funds will be irretrievable.

The stolen Bitcoin this year has yet to be recovered. The identity of the thieves is also still unknown.

Lack of price uniformity

Since cryptocurrency does not have a centralized system, its price can change depending on the platform. Most of the price exchanges vary. This makes it hard to create a standardized price charting for all its users.

ICO schemes

Some entrepreneurs use cryptocurrency as a means to scam other investors. They usually change the prices of tokens to attract investors. After cashing out, they usually leave the investors with little or no return money.

Interesting: What is Airdrop

The verdict?

Should you dive into crypto? Much has been said about crypto. Both positive and negative aspects have been highlighted by various industry specialists. One thing’s for sure. Crypto will continue to grow. And if you whttps://usethebitcoin.com/cryptotools/ant to have a stake in it, you’ve got your work cut out for you.

One of the most important concepts you need to learn is DYOR, meaning Do Your Own Research. You will be hearing this term a lot once you start to dive into cryptocurrency. Educate yourself. Learn about the different concepts, tools, and strategies in the cryptocurrency market. If you’re going to take the plunge, better do thorough research and understand the ins and outs of it. In taking risks, it’s better to arm yourself with as much knowledge you can find rather than to go in blindly.